Payments Out Service

Power your solution with electronic payments

The Payments Out Service lets Sage customers make payments directly from their software. We use a trusted payment provider to submit electronics payments. This means customers can automate payments, eliminate manual processes, and reduce errors.

Intacct

Sage Business Cloud Payroll

Overview

Capabilities of the Sage Payments Out Service

Payments Out Service

- Search supported payment providers

- Simple customer onboarding

- Quickly enable debtors and creditors

- Secure electronic payment submissions

- Automatically retrieve updates on each payment status

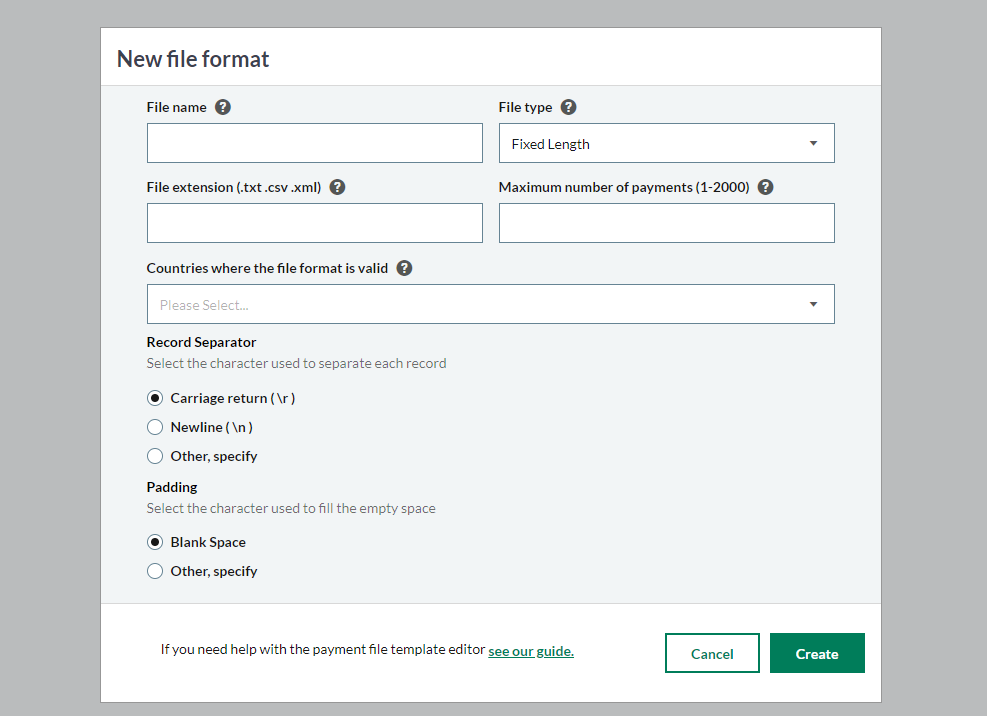

- Generate bank payment files

Customer stories

How your customers can benefit from electronic vendor payments

Automate outgoing payments

Reduces the risk of human errors created through manual data entry.

Reduce payment costs

Lower transaction costs allow for lower admin overhead.

Flexible transaction types

Payment Out Service covers many different transaction types creating more options for the payee.

Increased security

Rest assured knowing that your outgoing payments are processed safely and securely.

See how Sage Intacct customers are benefiting

Sage Payments Out Service serves as a bridge between Sage Intacct’s best-in-class financials and Corporate Spending Innovations’ (CSI) trusted payments platform to deliver a seamless payment experience from bill to reconciliation.

Estimated annual benefits

396 hours

Regained annually in productivity vs manual checks

$48,000

Annual Savings in transaction costs vs manual check

$6,000+

Annual earnings in cash rebates vs manual or ACH

* Based on: Transaction savings of $4 per check, 1,000 payments totaling $1M per month, 10% conversion to virtual card

Customer Pain Points

I spend too much time having to mail out checks

The Payments Out Service capabilities save time and materials vs mailing out checks manually. It also helps to reduce errors and simplify reconciliations.

I currently have inefficient work processes

The Payments Out Service capabilities help streamline workflows without having to leave the Sage product.

I have lack of visibility on the performance of my business

The Payments Out Service capabilities mean you always know where your payments stand with detailed status updates and easily matched bills and payments.

"This has allowed our accounting team to make payments from home easily. They do not have to print and mail manual checks which would require check stock, a printer, envelopes, postage, and a trip to the postage office. This saves us time and material... this helps us push toawards being as green as possible."

Alicia Summers - Vice president of finance, Agemark Senior Living

Electronic payments flow

1.

Choose a provider

Search from the available providers in your region and select one best for you. Follow the subscription process to onboard with the provider.

2.

Add a bank account

Submit banking information for the account you'd like to fund your payments through. You may add as many bank accounts as needed.

3.

Create vendors

Enter your vendor and supplier payment information such as bank details, payment amount, invoice number to start making payments.

4.

Process payments

After payment is approved and made, the payment provider processes the payment and posts to vendor's bank account. When the payment is made, the status is updated in your Sage product and the transaction is automatically reconciled.

Seamless Payment Experience

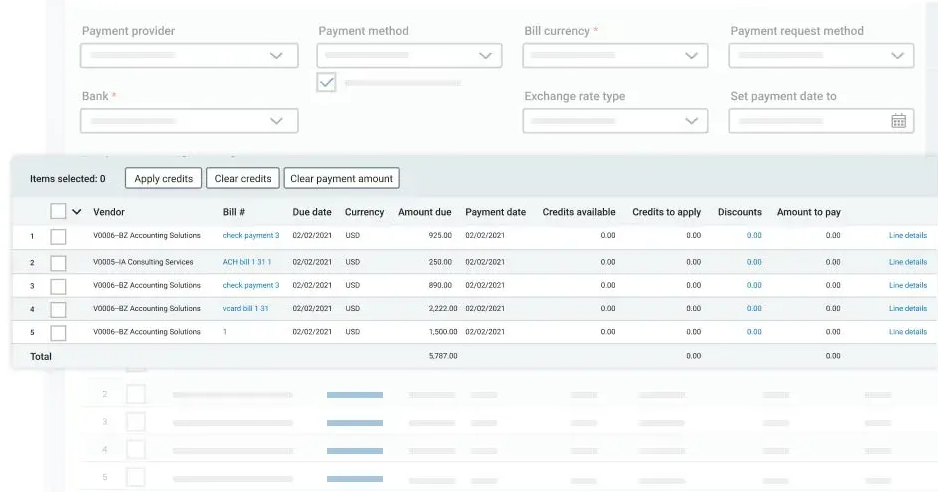

Bank payment file flow

1.

Add payments

Select payments within your Sage solution and create a payment file.

2.

Export payments

When generated, download the required payment file type.

3.

Import payments

Upload the payment file into the online banking portal.

4.

Submit payments

The bank will process the payment file to make the payments.

Key contacts

Select a contact to start a Teams chat.

Start building with the Sage Payments Out Service.

Explore. Setup. Integrate. Launch🚀

Start building >