Banking Service

Power your solution with financial data

Banking Service reduces manual data entry and automates tasks for Sage customers. This service helps businesses become more efficient by enabling customers to automatically download and categorise incoming and outgoing transactions from their bank to their Sage solution.

20%

Said automated bank reconciliation would be the most valuable improvement to their accounting system

27%

Said new or improved bank integrations would enhance their Account payable process

22%

Said automated reconciliation capabilities would help relieve their organisations biggest pain points

* Source: IDC EMEA, IDC Europe AP/AR Survey, Sage, October 2021

Accounting

200c Accounts

50c Accounts

Intacct

Overview

Capabilities of the Sage Banking Service

Banking Service

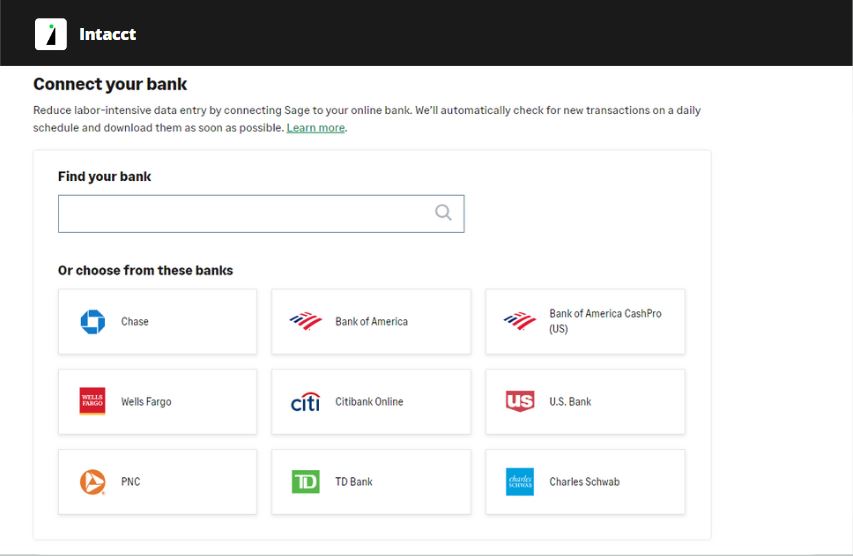

- Search supported banks

- Simple customer onboarding

- Import and pull bank transactions

- Automatic transaction categorisation

- Reliable customer re-authorisation

- Quickly connect multiple accounts

Bank feeds

Link online bank accounts directly to your solution for automatic import of transaction data.

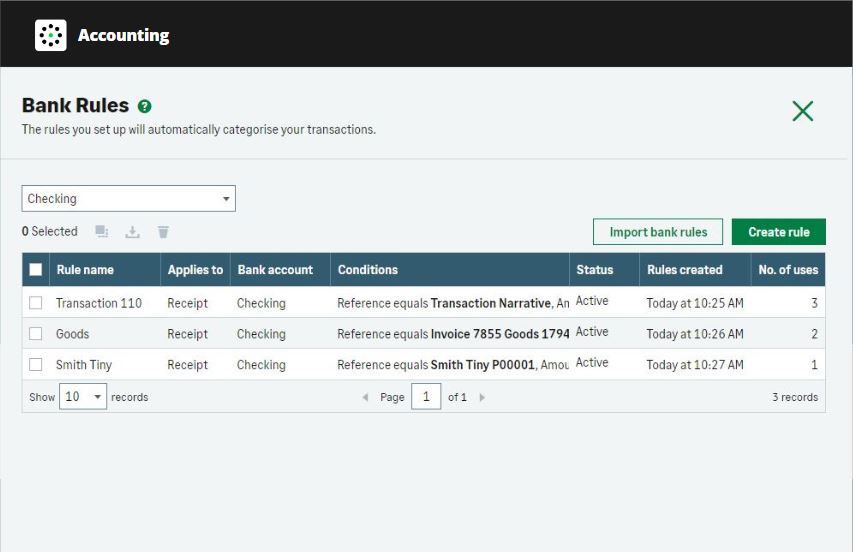

Learn more about bank feeds.Bank rules

Create automated rules that categorise imported online banking transactions in your solution.

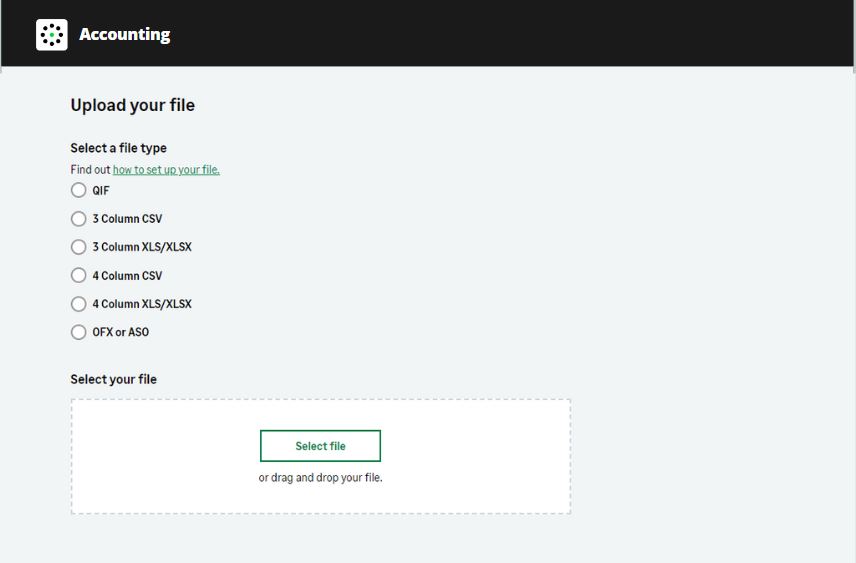

Learn more about rules.Transaction import

Allow customers to import data from their bank in a variety of file formats.

Learn more about transaction import.

Customer stories

How your customers can benefit from Banking Service

Increased accuracy

Reduces the risk of human errors created through manual data entry.

Saves time

Automatically import and categorise transactions from your bank.

Easy to use

Customers can easily reconcile accounts and categorise transactions with just a few clicks.

Improved workflow

Streamlines workflows with the elimination of manual data entry.

See how accounting customers are benefiting

The Provider API enables banks and financial institutions to push customer transactions into the Sage Banking Service,

8hrs

saved on average reconciling bank transactions.

80%

of time reduced on manual data entry.

80%

of Sage customers find reconciliation easy.

Customer pain points

I spend too much time on manual data entry

The Banking Service capabilities save time by automatically importing transactions from financial institutions,giving customers more time to focus on what their business needs.I currently have inefficient work processes

The Banking Service capabilities help streamline workflows with the elimination of manual data entry and automated bank reconciliation processes.I have lack of visibility on the performance of my business

The capabilities enable customers to stay on top of their transactions and keep their accounts accurate, giving them greater visibility and control over their cash flow and empowers businesses with insights to make smarter decisions.

"I can easily access my accounts and I know what’s going on. I can check whether a customer has actually paid me because it’s connected to my bank account."

Janice B. Gordon - Founder, Scale Your Sales

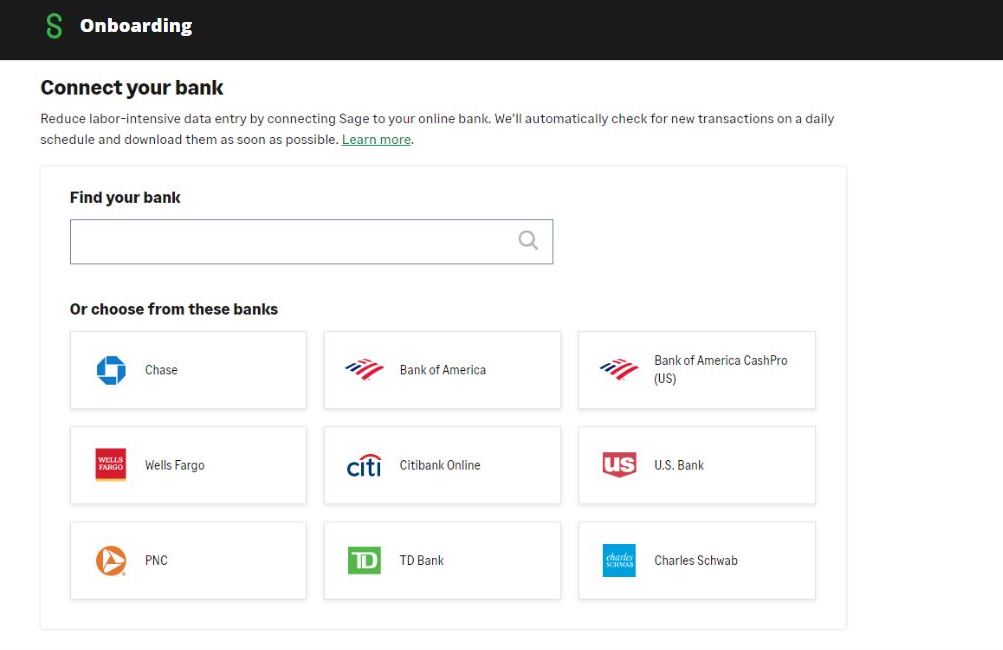

Bank feed capabilities

1.

Onboard

Allow users to connect their bank account to their Sage product.

2.

Multi-account link

Easily connect additional accounts under the same authorisation.

3.

Get transactions

Pull transactional data for the users connected accounts.

4.

Reauthenticate

Reconnect accounts when authorisation has expired.

5.

Transaction recall

Delete or replace transactions that require amendment.

6.

Offboarding

Users can disconnect their bank account when required.

Bank feed types

Direct

An offline process where the user must complete steps outside of Sage UI to link their accounts.

Indirect

Authorisation takes place in the onboarding flow and in most cases is instantly connected.

Seamless onboarding experience

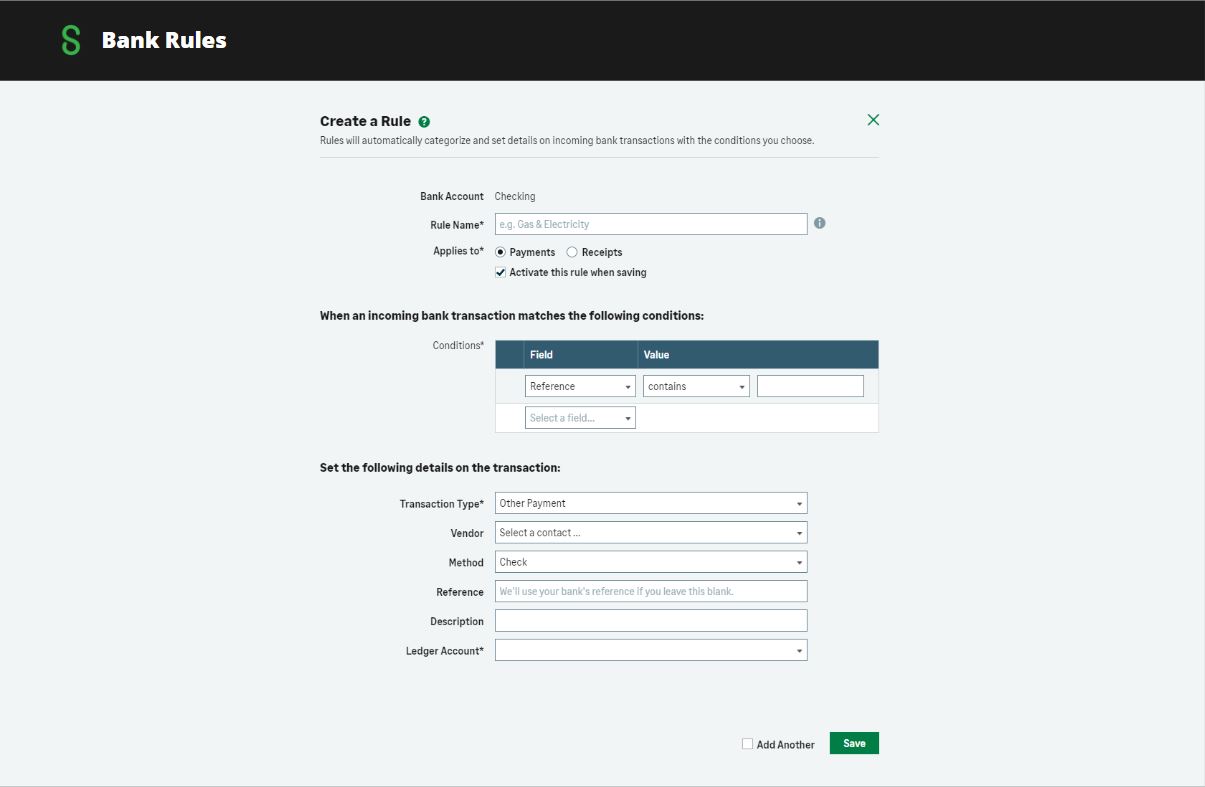

Bank rule capabilities

1.

Create rules

Reduces the risk of human errors created through manual data entry.

2.

Rule matching and ranking

Automatically import and categorise transactions from your bank.

3.

Manage rules

Customers can easily amend, reorder or delete rules within their solution.

4.

Re-process rules

After making changes to rules the customer may wish to run rules processing again for a set of transactions.

Simple bank rule creation

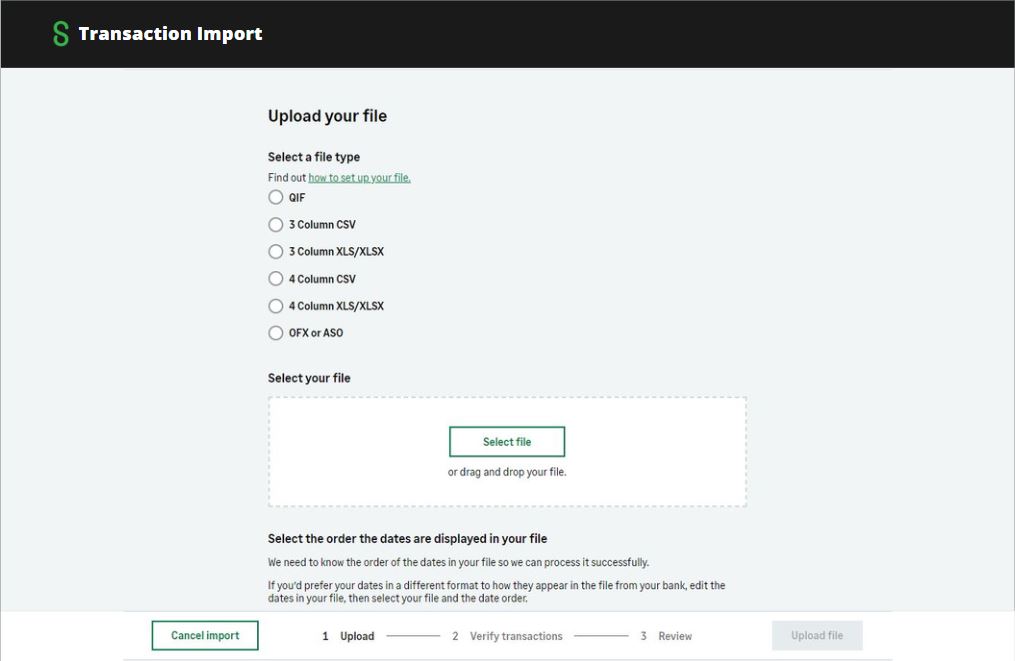

Transaction import capabilities

1.

Import into placeholder

If their bank is not currently available through Bank feeds, import files to a placeholder account.

2.

Convert to a real bank feed

Easily switch placeholder accounts to fully connected when their bank becomes available.

3.

Transaction top up

Customers connected to a bank feed can ‘top up’ transactions for various scenarios.

Easily import transactions

Key contacts

Select a contact to start a Teams chat.

Joe Bell

Product manager

Product requirements

Vicens Chamorro

Director of engineering

Engineering requirements

Robbie Kelsey

Solution designer

Design requirements

Kay Stewart-Johnson

Senior enablement engineer

Integration support

Jordan Hall

Enablement engineer

Integration support

Grace Kudom

Product marketing manager

Marketing requirements