Domestic Reverse Charge VAT

Less than to read

What is Domestic Reverse Charge VAT

Introduced in June 2007, Domestic Reverse Charge VAT became applicable to UK VAT registered individuals and businesses who buy or sell specified goods and services. A complete guide to those goods and services can be found in the published HMRC reverse charge procedure.

From the 1st of March 2021 UK Businesses who are VAT registered and are reported within the constructions Industry Scheme must now also use reverse charge VAT for most supplies of building and construction services. This affects supplies at the standard rate of 20% or the reduced 5% rates. Zero-rated supplies are unaffected.

A government guide to DRC for the Construction Industry Scheme is available here.

Accounting for DRC in Sage Business Cloud Accounting

Sage Business Cloud Accounting now makes it possible for businesses to Account for DRC VAT transactions by flagging both contacts and artefacts with DRC attribute values. In addition to being accessible in the SBC Accounting web application, DRC attribute values are also available to get and set via the API’s contacts and artefacts endpoints.

You can find our complete guide to Domestic Reverse Charge VAT here.

The following table shows the endpoints where the DRC attribute is available along with the DRC attribute value:

| Endpoint | Attribute | Value |

|---|---|---|

| contacts | tax_calculation | domestic_reverse_charge |

| sales_invoices | vat_reverse_charge | true |

| sales_credit_notes | vat_reverse_charge | true |

| sales_quotes | vat_reverse_charge | true |

| sales_estimates | vat_reverse_charge | true |

| purchase_invoices | vat_reverse_charge | true |

| purchase_credit_notes | vat_reverse_charge | true |

Creating a sales_invoice with DRC

In this example, the contact defined is a DRC and CIS registered customer and the ledger_account_id is for account 4911 CIS labour. Note the ‘vat_reverse_charge’ being set to true at the invoice header level and not at item level. This means that DRC impacted items cannot be mixed with non DRC items on the same invoice.

Note To ensure the VAT return is calculated correctly it is vital that the ‘tax_amount’ and ‘tax_rate_id’ values are set.

POST /sales_invoices

Content-Type: application/json

{

"sales_invoice": {

"contact_id": "ed64c638e9e6427ca60af76e366c079f",

"date": "2021-03-01",

"reference": "reference",

"notes": "notes",

"vat_reverse_charge": true,

"delivery_address": {

"address_line_1": "North Park",

"address_line_2": "Gosforth",

"city": "Newcastle Upon Tyne",

"postal_code": "NE13 9AA",

"country_id": "GB"

},

"invoice_lines": [

{

"description": "Test CIS Labour",

"ledger_account_id": "4e353d3e704211eb928b0276e9cfd239",

"unit_price": 200.00,

"total_amount": 240.00,

"tax_amount":40.00,

"quantity": 1,

"tax_rate_id": "GB_STANDARD"

}

]

}

}

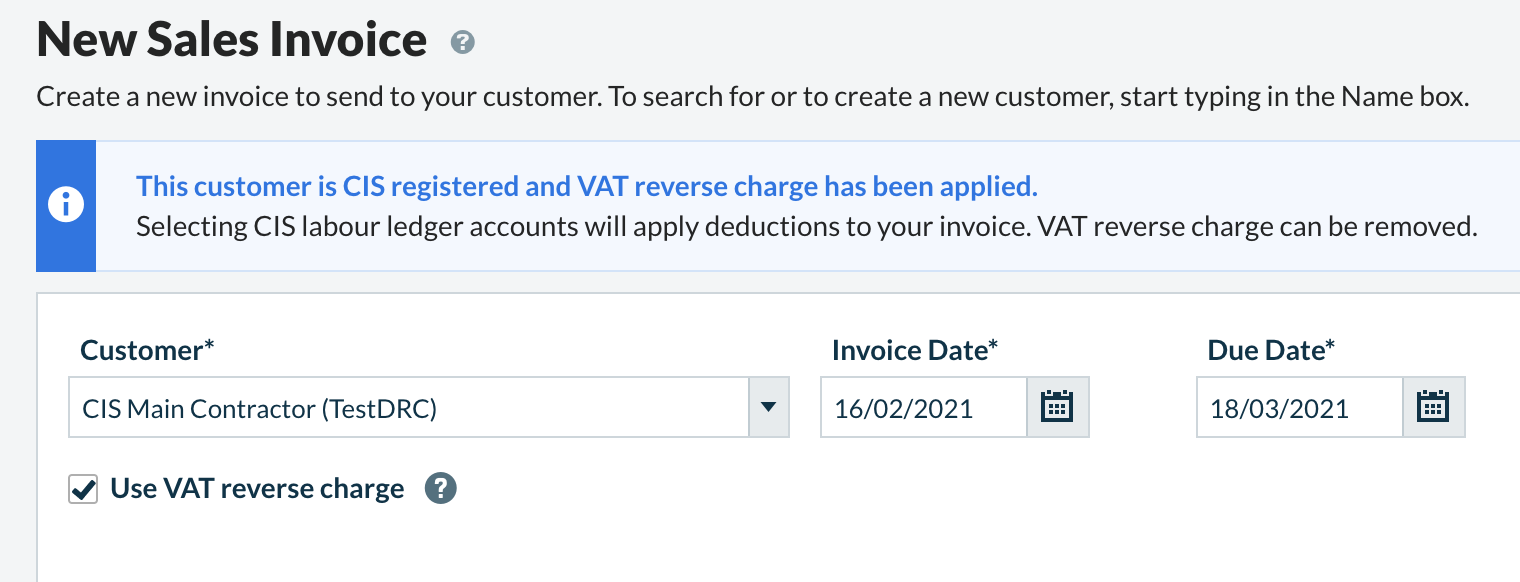

UI View of a DRC Sales Invoice header

The SBC Accounting API uses the following validation before allowing a contact to be set for DRC:

- Must be a UK VAT registered business.

- A valid VAT number must be set for the DRC contact.

- A contact is automatically set to DRC if they are already flagged as a UK VAT registered CIS contact.

The artefact ‘vat_reverse_charge’ boolean is validated with the below rules. Should a POST request fail any validation an error response is returned:

- The business is a UK tax registered business.

- The artefact ‘vat_reverse_charge’ boolean must be set to true or false if the contact has the ‘tax_calculation attribute’ set to domestic_reverse_charge.

- The artefact ‘vat_reverse_charge’ boolean must not be set if the associated contact ‘tax_calculation attribute’ is not set to domestic_reverse_charge.

- When creating a credit note, the credit note is allocated to the originating DRC invoice.

In addition to the above, artefacts created for contacts flagged for both CIS and DRC (‘tax_calculation’ attribute set to domestic_reverse_charge) must adhere to the following additional validation:

- The boolean attribute value for ‘vat_reverse_charge’ must be set on all POST requests dated 1st March 2021 or later.

- The boolean attribute value for ‘vat_reverse_charge’ must not be set on artefacts dated before 1st March 2021.

- The boolean attribute value for ‘vat_reverse_charge’ must be set to true or false if the contact has the ‘tax_calculation attribute’ set to domestic_reverse_charge and is flagged as a CIS contact.