The

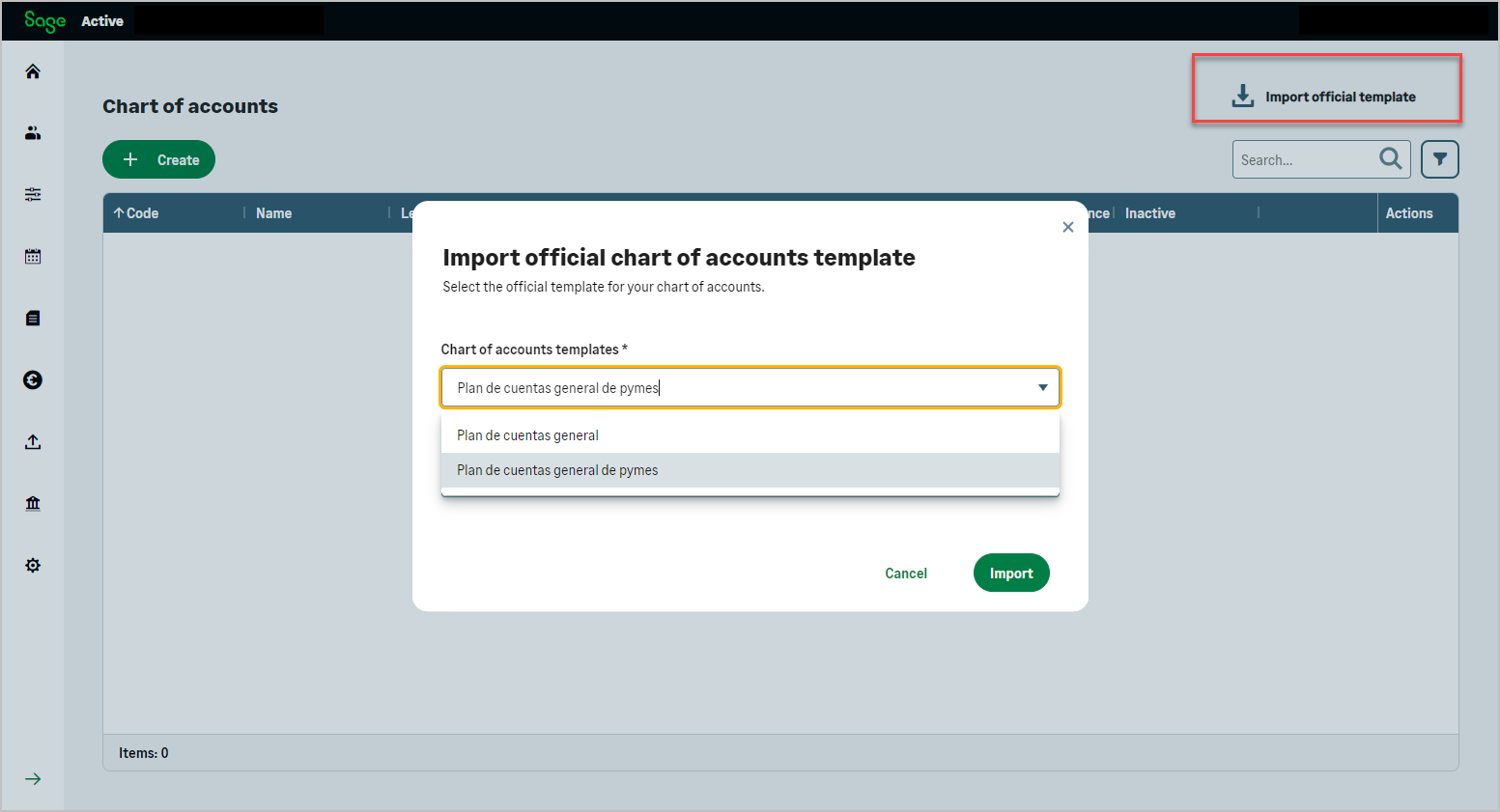

accountingPlanMaster resource represents the standard templates of accounting plans delivered within the system. These templates are specific to the legislations of

FR (France),

ES (Spain), or

DE (Germany), reflecting the reference accounting plan models for each jurisdiction.

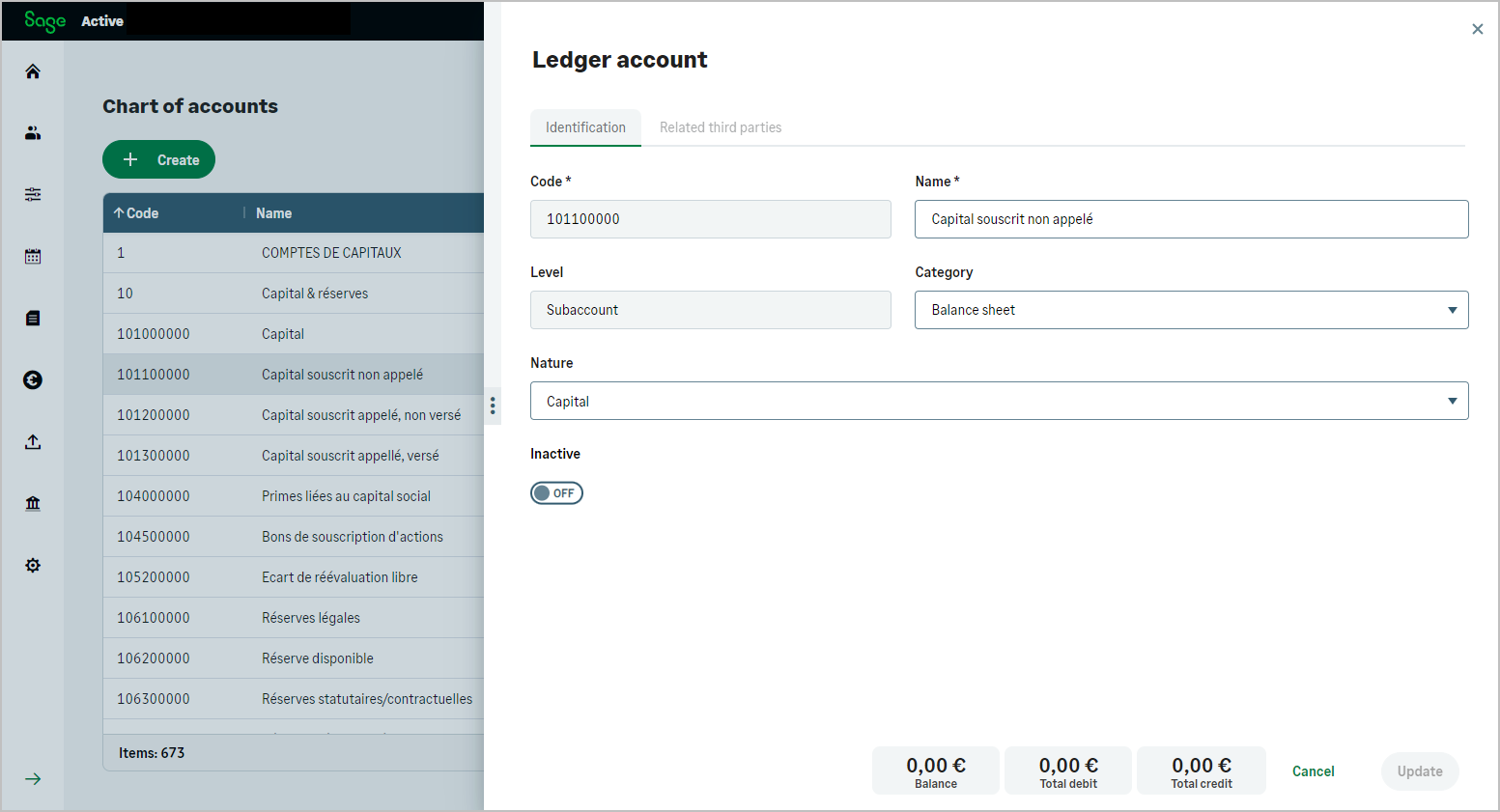

These models are distinct from the accountingaccount resource, and if a model is not imported, its associated accounts will not be available within the organization.

The primary purpose of this resource is to retrieve the template of an accounting plan to identify the standard accounting plans used in Sage Active and also to allow the importation of a template into an empty accounting plan.

It facilitates aligning the accounting practices with the legal standards of the respective country, ensuring accuracy and compliance but does not have any other utility within the system.