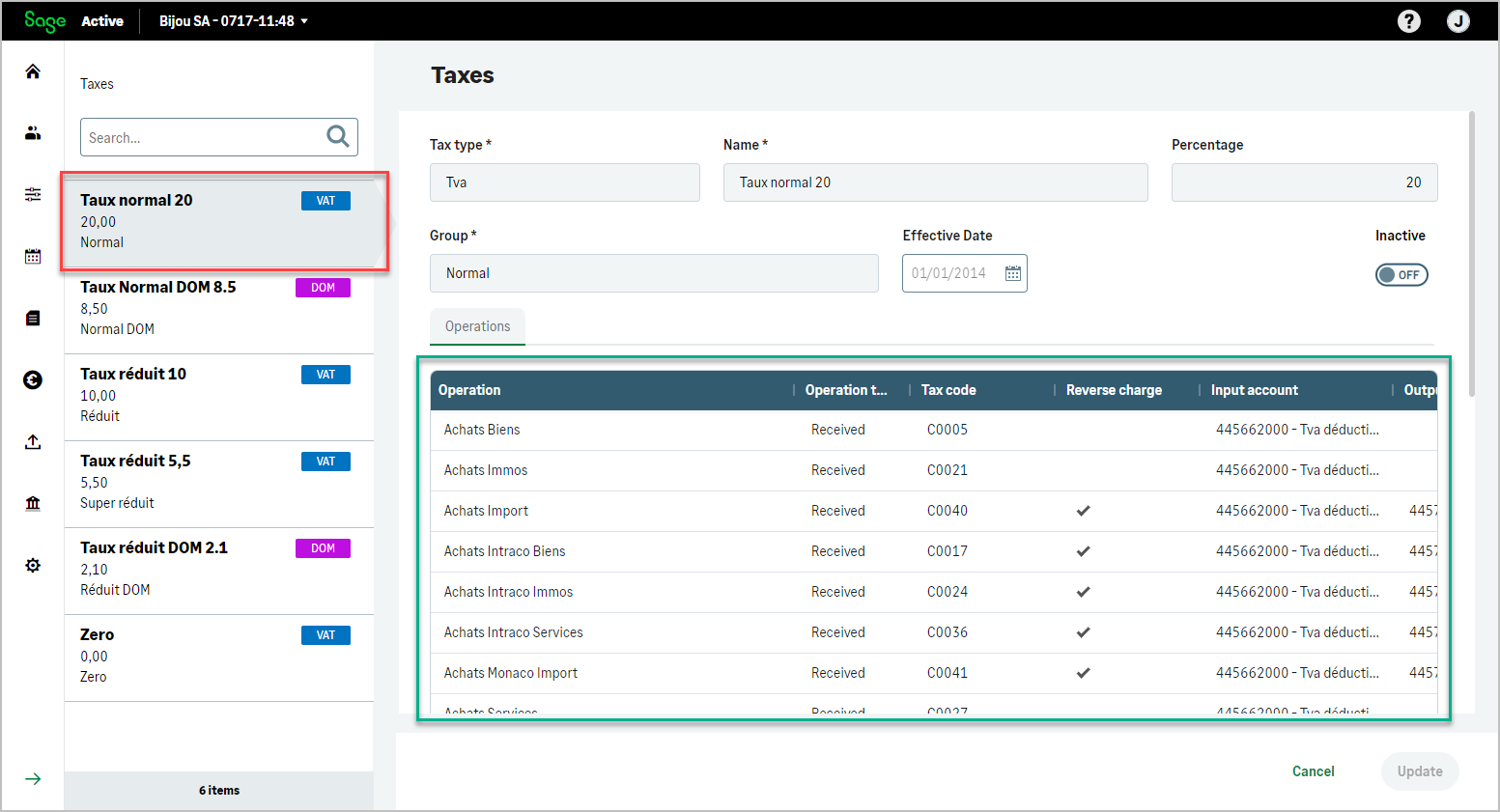

This association simplifies the entry of sales or purchase records within the accounting system.

For example, when entering a sales invoice, if the net sales account is linked to a tax code, the associated tax account will be automatically proposed.

The calculation of the net and VAT will be automatic according to the percentage of the tax.