- sales: Used for entering customer sales accounting documents, providing access to deadlines and taxes.

- purchases: Used for entering supplier purchase accounting documents, providing access to deadlines and taxes.

- financial: Used for entering customer/supplier payments and other banking operations.

- general: Used for entering miscellaneous accounting documents.

- carry forward: Used at the close of the fiscal year to generate carry forward entries.

JournalType

Quick Links

Accounts Accounting Entries Products Customers Sales quotes Sales invoices Suppliers Purchase invoices| HTTP | Operation | Type | Object | DTO Why-DTOs? |

|---|---|---|---|---|

| Mutation Why 200? | createJournalType |

JournalTypeCreateGLDtoInput |

||

| Mutation Why 200? | deleteJournalType |

JournalTypeDeleteGLDtoInput |

||

| Query | journalTypes filtered by id Why? |

|||

| Query | journalTypes |

Description

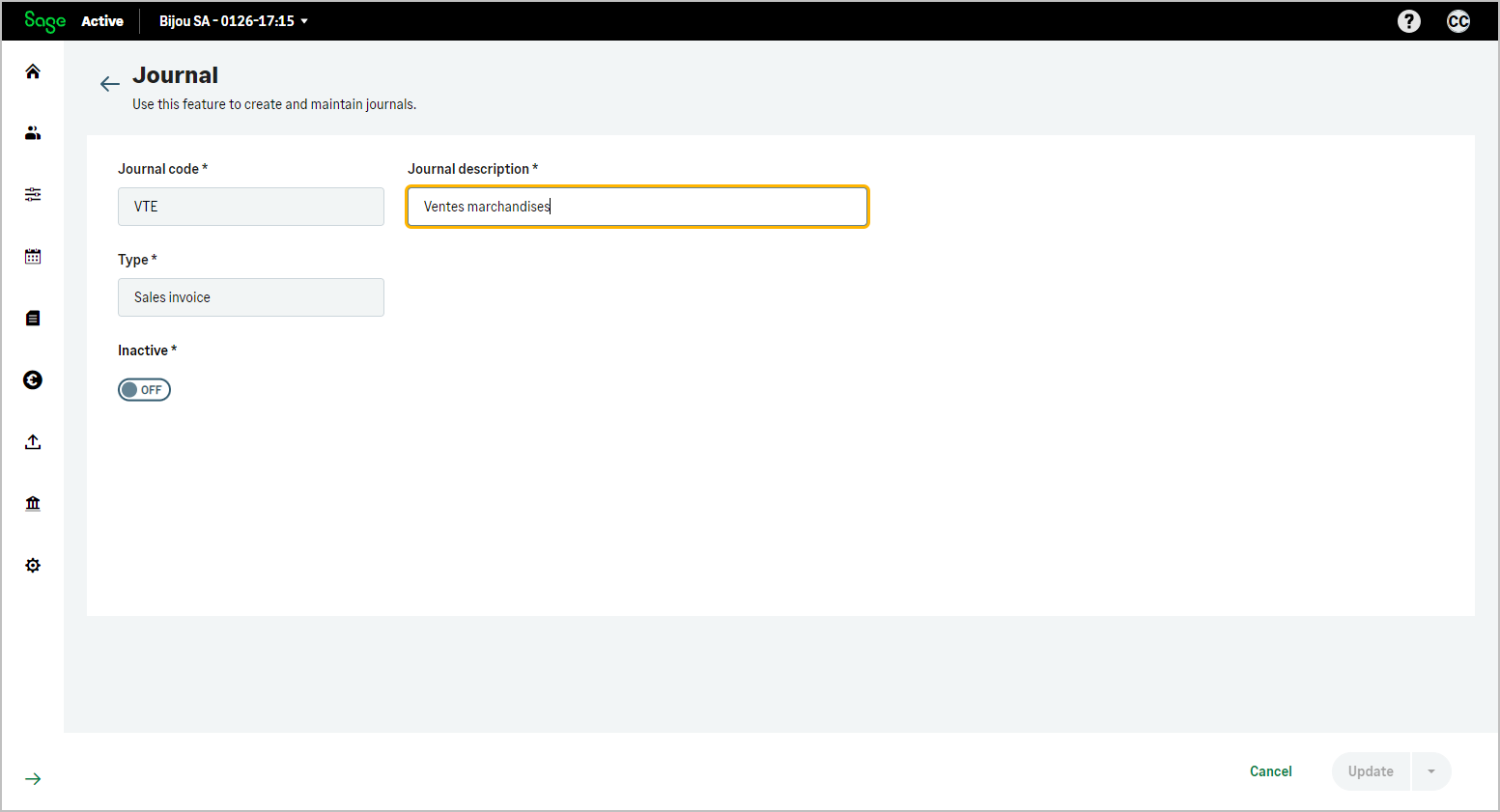

Define the various journals used during the entry of accounting documents, known as JournalType in the API context and Journal in the product interface.

It’s important to note that these definitions refer to the definition of the journals themselves and not to the grouped entries that are found in the accountingEntry.

Each journal is associated with a specific type:

Header

| Key | Value |

|---|---|

Authorization |

Bearer Current access Token How to find? |

X-TenantId |

Current tenant id How to find? |

X-OrganizationId |

Current organization Id How to find? |

x-api-key |

Primary or secondary subscription key of your app How to find? |

journalTypes

| Fields | Type | Description | Length |

|---|---|---|---|

| id | UUID | Id | |

| creationDate |

DateTime | Creation Date | |

| modificationDate |

DateTime | Modification Date | |

| code |

String | Code | 20 |

| name |

String | Name | 50 |

| deactivated |

Boolean | Deactivated |

|

| type |

|

Type |

|

| isCreditNote | Boolean | Indicates whether the document is a credit note. |

|

| creditNoteReason |

|

Specifies the reason for issuing the credit note. |

|

| accountingAccount |

AccountingAccount | Fields of AccountingAccount | |

| accountingAccountId | UUID | Account |

Info

- accountingAccountId :Used to define an account for type

Financial,Carry forwardandGeneral - deactivated : Deactivating an Journal means that the Journal is not available for generate new accounting entries. But it will still be displayed in all the information that has been generated using that Journal.

- type :

- Financial: Customer/supplier payments and other banking operations.

- Carry forward: Close of the fiscal year to generate carry forward entries for fiscal year +1

- General: Miscellaneous accounting documents.

- Purchases: Supplier purchase accounting documents.

- Sales: Sales accounting documents.

Closing: unused for the French market

- Financial: Customer/supplier payments and other banking operations.

- Carry forward: Close of the fiscal year to generate carry forward entries for fiscal year +1

- General: Miscellaneous accounting documents.

- Purchases: Supplier purchase accounting documents.

- Sales: Sales accounting documents.

- Closing : Close of the current fiscal year.

- Financial: Customer/supplier payments and other banking operations.

- Carry forward: Close of the fiscal year to generate carry forward entries for fiscal year +1

- General: Miscellaneous accounting documents.

- Purchases: Supplier purchase accounting documents.

- Sales: Sales accounting documents.

Closing: unused for the German market

- isCreditNote

- creditNoteReason:

Only for Spanish legislation

For Spanish legislation, and only if the journal type is

PURCHASE_INVOICEorSALES_INVOICE, it is possible to specify that the journal is used for credit notes.

In this case, it is mandatory to specify a reason by selecting one of the following values:R1: Return of packaging- Used when goods include packaging that is later returned, requiring an invoice adjustment.

R2: Bankruptcy proceedings- Issued in cases where the debtor enters bankruptcy and VAT correction is needed.

R3: Bad debt- Used when the original invoice cannot be collected due to non-payment, allowing VAT recovery.

R4: Other corrective invoices- Covers general corrections not included in other predefined categories.

R5: Simplified invoice correction- Used when correcting simplified invoices (i.e., receipts instead of full invoices).

Only for Spanish legislation