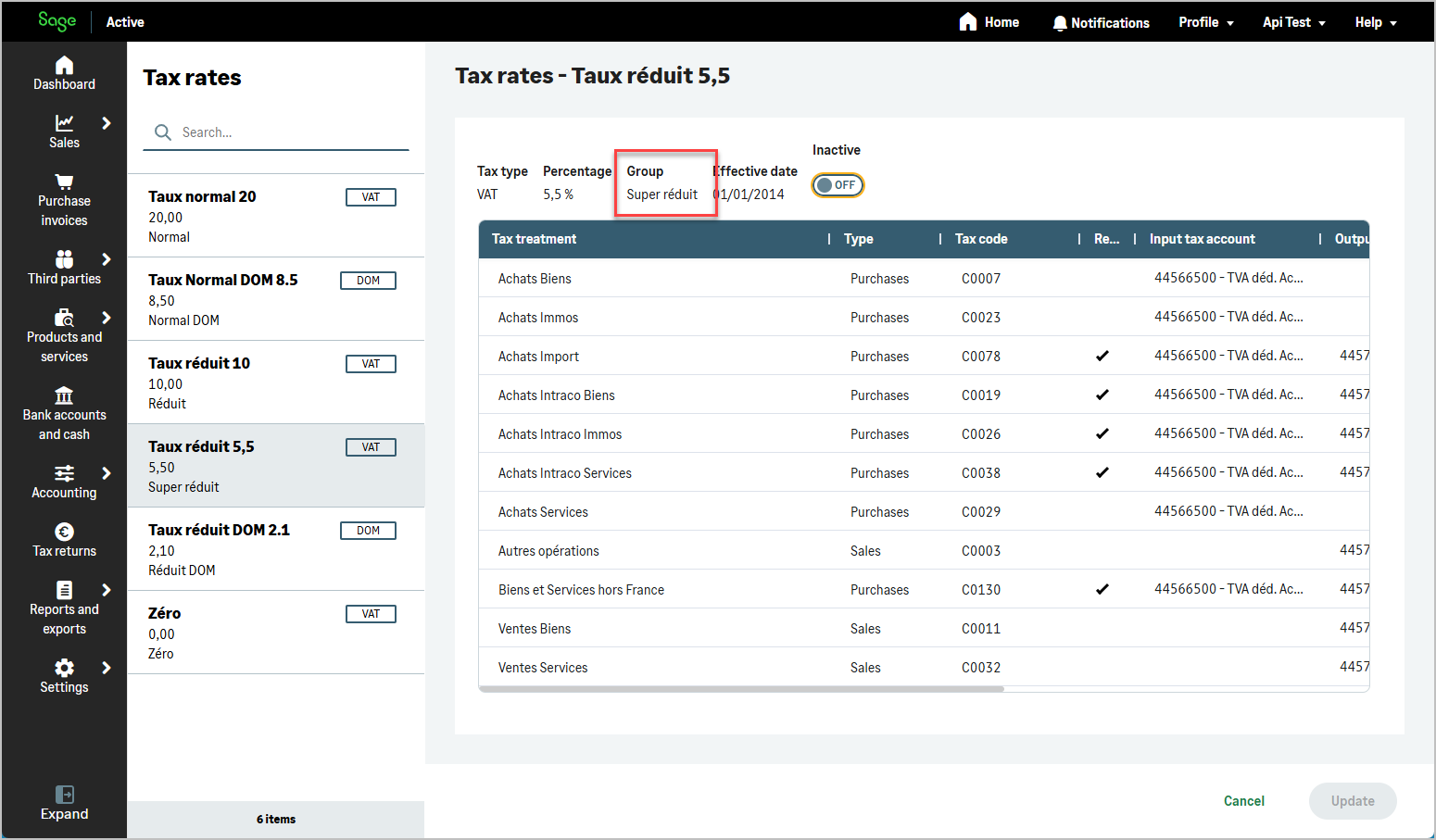

A Tax Group allows businesses to efficiently manage multiple tax rates and rules that apply to specific transactions, ensuring consistency and compliance with tax regulations.

Each tax group is associated with multiple taxes and serves as a reference for tax calculations in accounting and sales transactions.

By using tax groups, organizations can streamline tax application and reporting processes while maintaining flexibility to adapt to legislative changes.