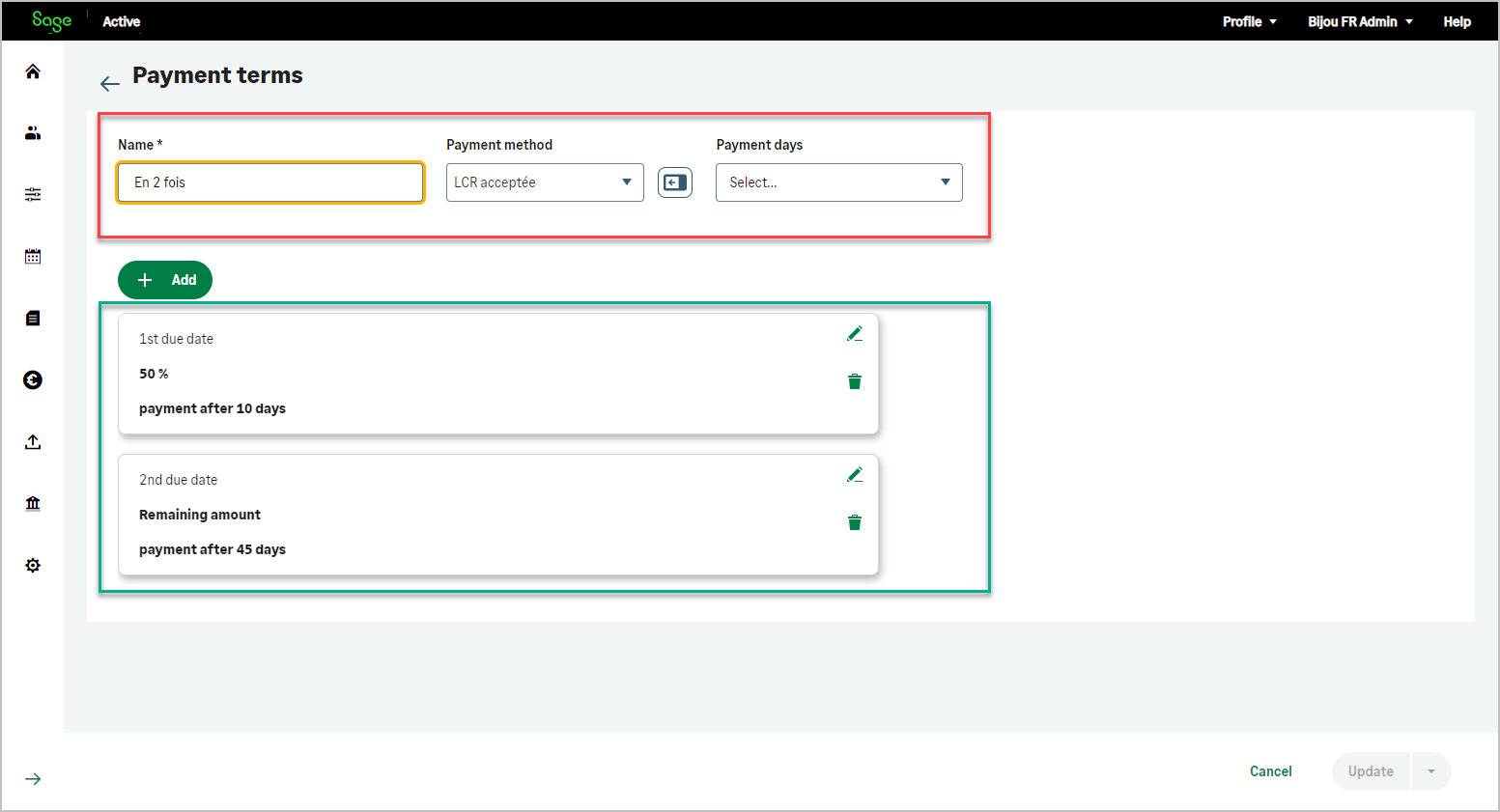

Example of a template :

- Advance payment by check 30%

- 30% by transfer at 30 days net

- the balance of 40% by bank transfer at 60 days end of month

Within the PaymentTerm, the specific conditions of payment are detailed under paymentTerms/lines.

| HTTP | Operation | Type | Object | DTO Why-DTOs? |

|---|---|---|---|---|

| Mutation Why 200? | createPaymentTerm |

PaymentTermCreateGLDtoInput |

||

| Mutation Why 200? | deletePaymentTerm |

PaymentTermDeleteGLDtoInput |

||

| Query | paymentTerms filtered by id Why? |

|||

| Query | paymentTerms |

Within the PaymentTerm, the specific conditions of payment are detailed under paymentTerms/lines.

| Key | Value |

|---|---|

Authorization |

Bearer Current access Token How to find? |

X-TenantId |

Current tenant id How to find? |

X-OrganizationId |

Current organization Id How to find? |

x-api-key |

Primary or secondary subscription key of your app How to find? |

| Fields | Type | Description | Length |

|---|---|---|---|

| id | UUID | Id | |

| creationDate |

DateTime | Creation Date | |

| modificationDate |

DateTime | Modification Date | |

| name |

String | Name | 50 |

| lines[] | Array | List of all Payment terms |

Payment terms, used to define the list of payment terms for PaymentTerm

Example :

| Fields | Type | Description |

|---|---|---|

| id |

UUID | Id |

| creationDate |

DateTime | Creation Date |

| modificationDate |

DateTime | Modification Date |

| order |

Int | Classification of lines from 0 to n. |

| paymentMean |

PaymentMean | Fields of PaymentMean |

| paymentMeanId | UUID | Id of the payment mean |

| type |

|

Type of calculation for the payment term line |

| value |

Decimal | Numerical value used based on the type of calculation |

| condition |

|

To calculate due date |

| day | Int | Number of days |

| payDays[] | Int | Array of Optional due days |

REMAINING_AMOUNT, must always be last with the value 9999.NONE : No specific calculation is applied.PERCENTAGE : value represents a percentage of the total amount.FIXED_AMOUNT : value is a fixed monetary amount.REMAINING_AMOUNT : The remaining balance after all prior calculations. Must always be last in the order.type = PERCENTAGE, value should be between 0 and 100, indicating the percentage of the total amount.type = FIXED_AMOUNT, value is a fixed currency amount (e.g., 500 means a fixed payment of 500).type = REMAINING_AMOUNT, value is ignored, as the system automatically calculates the remaining balance.type = PERCENTAGE and value = 30, the payment term will cover 30% of the total amount.type = FIXED_AMOUNT and value = 500, the payment term will apply a fixed amount of 500.type = REMAINING_AMOUNT, the system will allocate the remaining balance after all prior lines are processed.