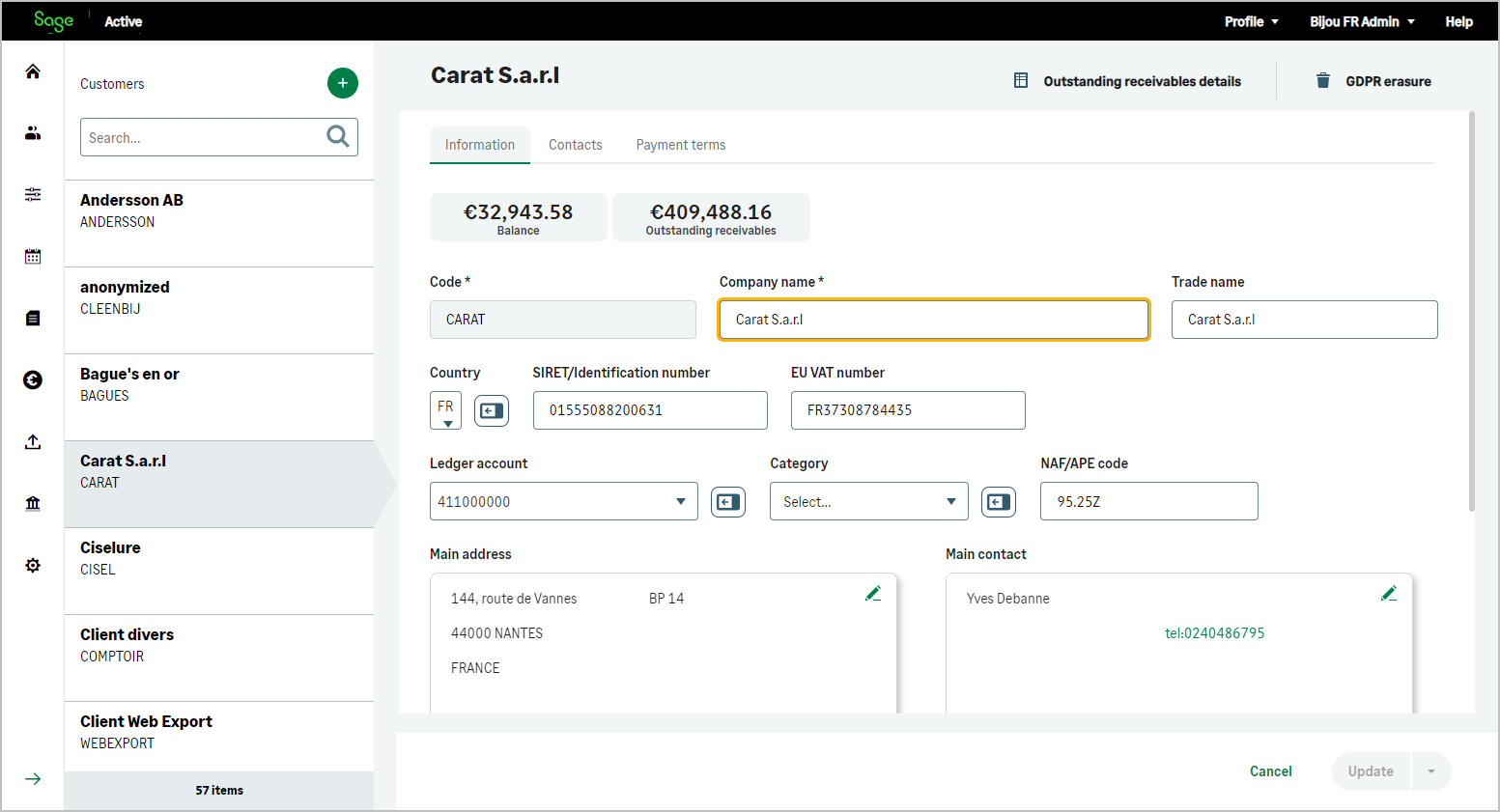

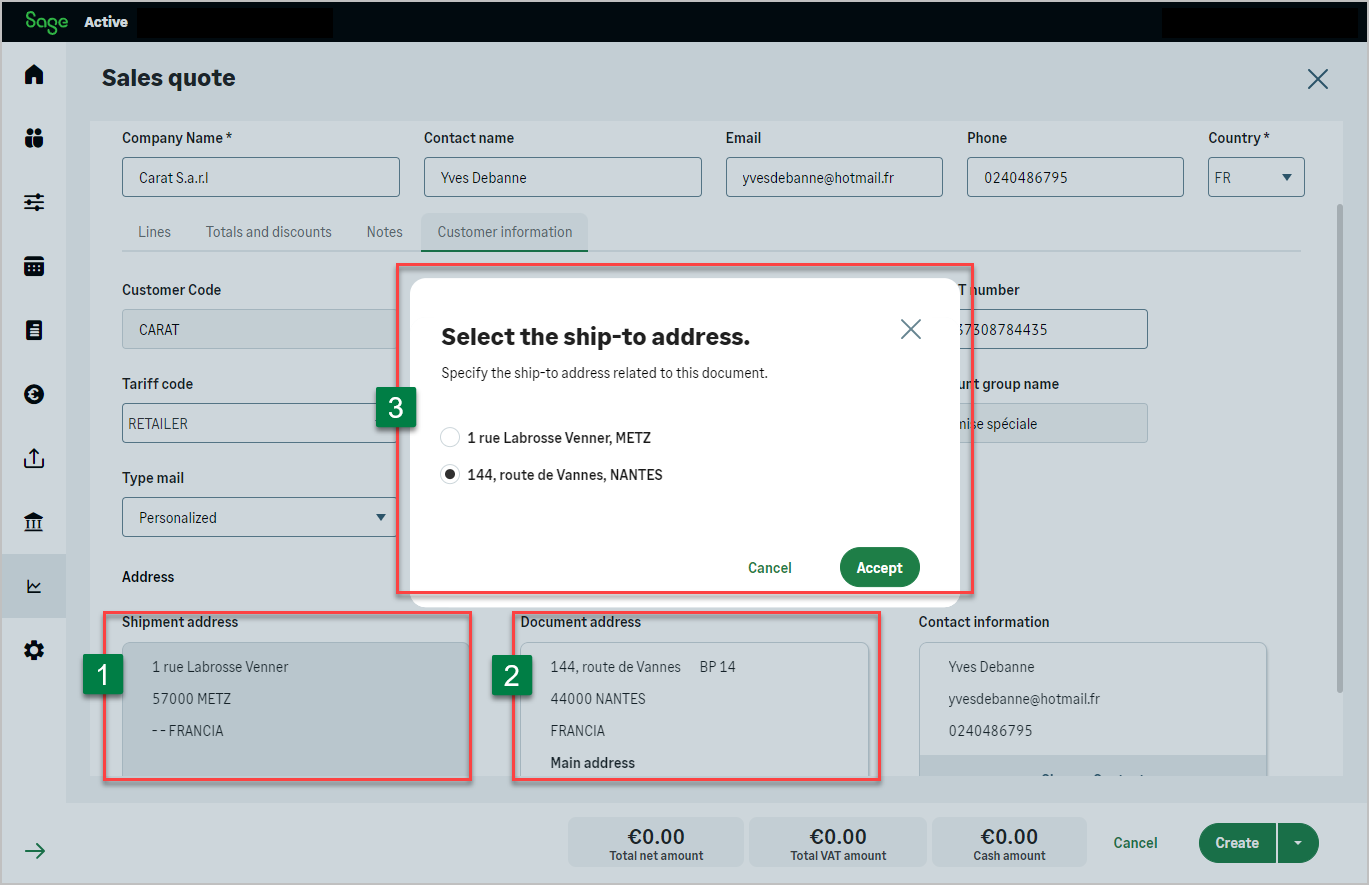

It offers the option to add contacts within the Customer and their details, as well as define the Customer’s default payment conditions.

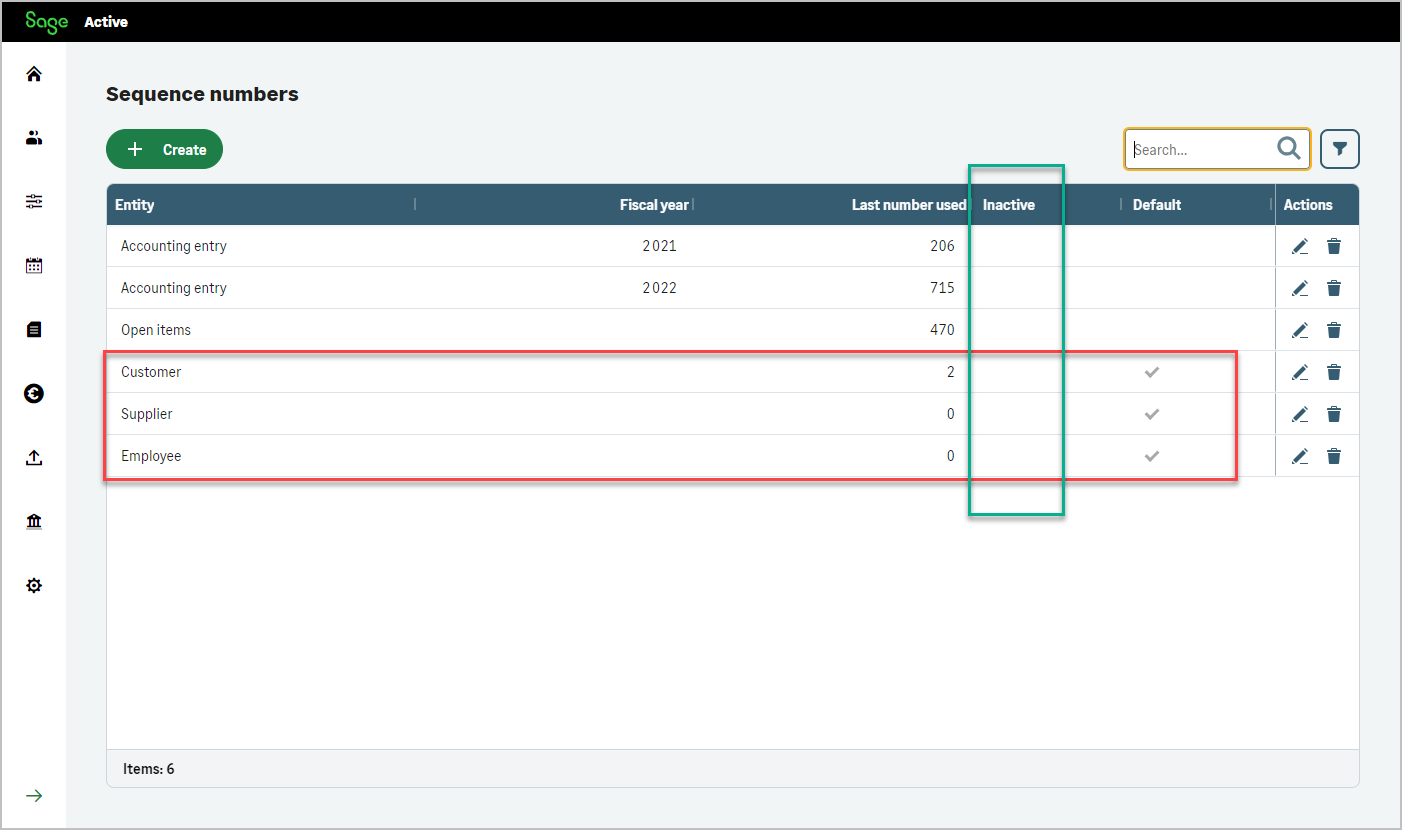

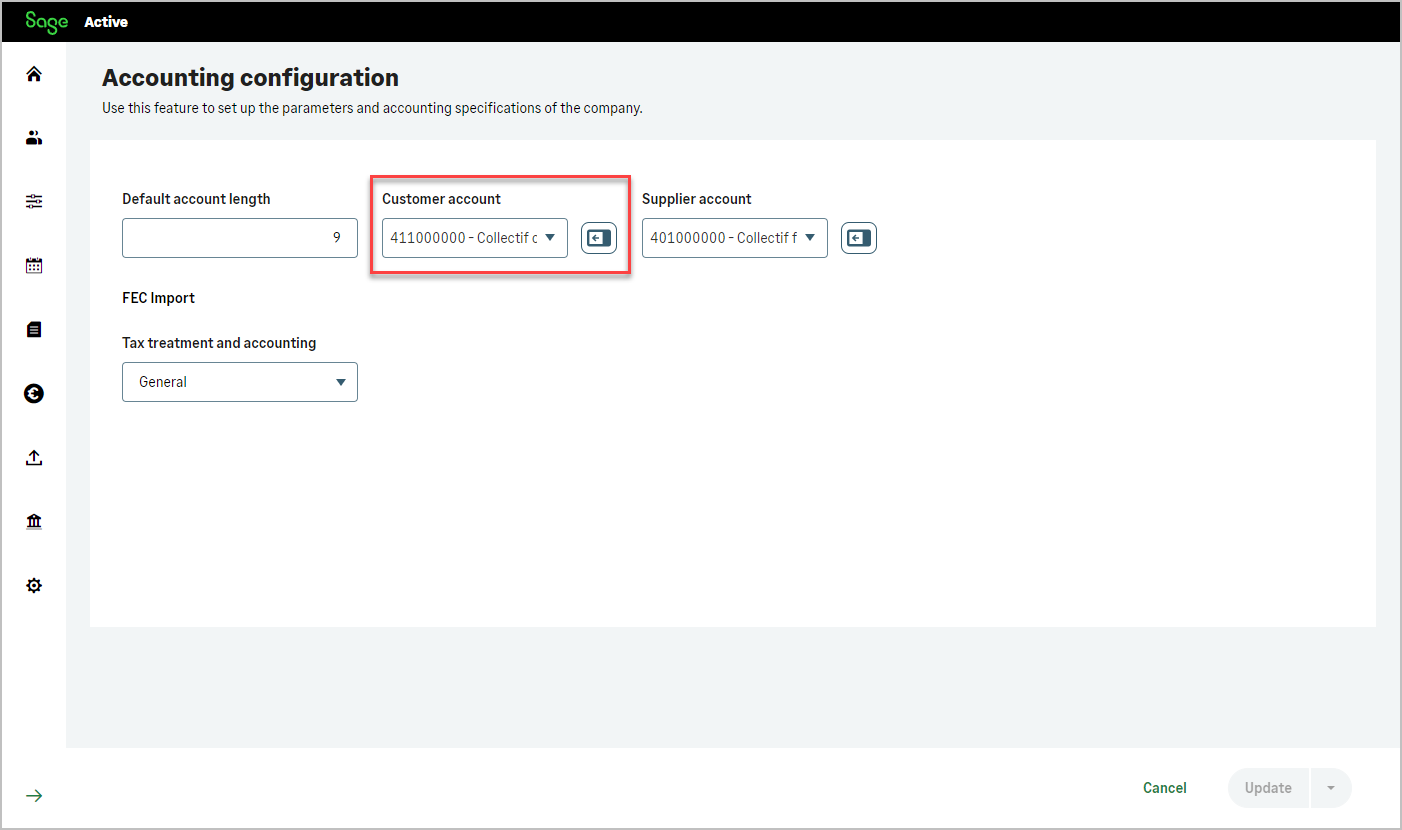

Every Customer must have a code, which, depending on the organization’s settings, can be manually entered or automatically generated.

In the DE (German) legislation, automatic numbering is mandatory.