FR, ES, or DE).These taxes are standard for each legislation and, therefore, cannot be modified.

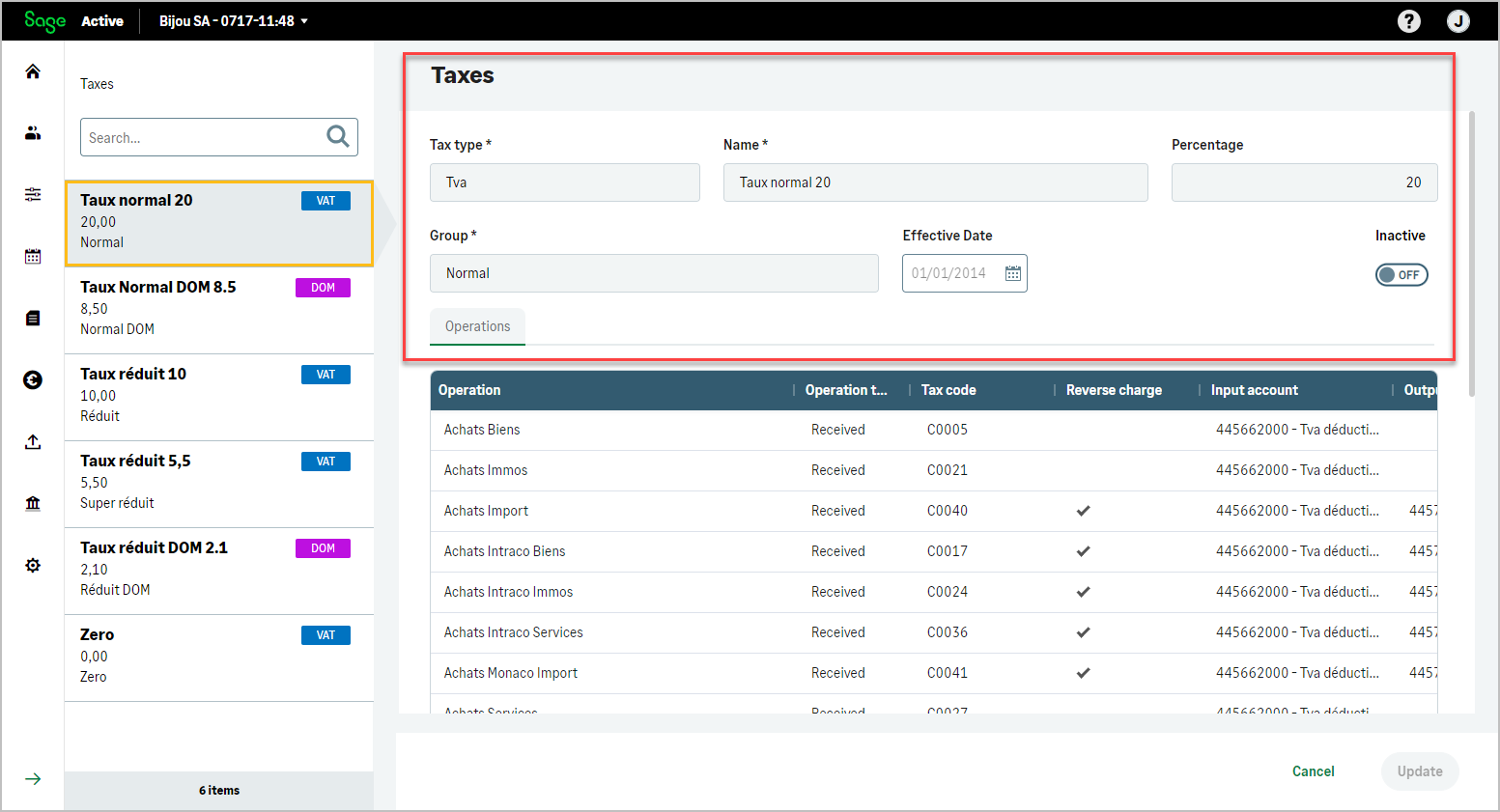

Each tax is defined by its name, percentages, and an associated group, reflecting the legal requirements and tax structures within the given legislation.

The management of these standardized taxes is essential for ensuring compliance with legal tax obligations and accurately reflecting the current tax laws within the accounting and sales domain.