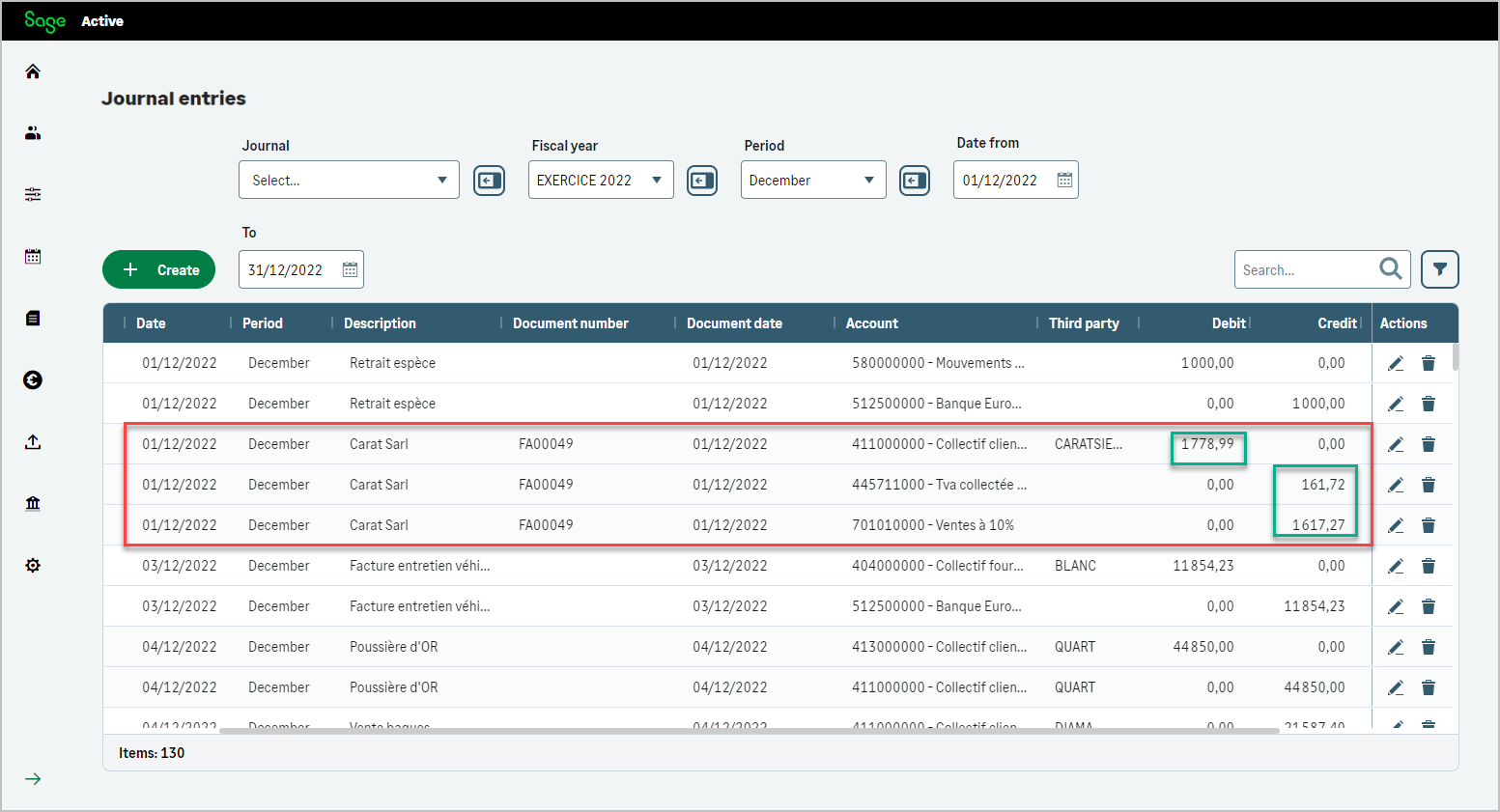

- These entries serve as crucial components of a company’s financial records, capturing various financial activities such as revenue generation, expense allocation, and asset acquisitions.

- Accounting entries are categorized and organized into journals based on their specific characteristics, and these characteristics are determined by the associated journal.

- It’s important to note that an accounting entry must be balanced, ensuring that debits equal credits.

- This means that accounting entries are complete accounting documents rather than individual lines of entries

AccountingEntry

Quick Links

Accounts Accounting Entries Products Customers Sales quotes Sales invoices Suppliers Purchase invoicesNote

There are several methods available for creating accounting entries.

This page provides information about the general structure of an accounting entry as returned in a query.

For the creation process, please refer to How to create?

| HTTP | Operation | Type | Object | DTO Why-DTOs? |

|---|---|---|---|---|

| Mutation Why 200? | How to create? | |||

| Mutation Why 200? | deleteAccountingEntry |

AccountingEntryDeleteGLDtoInput |

||

| Query | accountingEntries filtered by id Why? |

|||

| Query | accountingEntries |

|||

| Query | accountingEntryLines |

Description

Header

| Key | Value |

|---|---|

Authorization |

Bearer Current access Token How to find? |

X-TenantId |

Current tenant id How to find? |

X-OrganizationId |

Current organization Id How to find? |

x-api-key |

Primary or secondary subscription key of your app How to find? |

Quick Tips

It is possible to query either accountingEntry, accountingEntryLines, accountingEntryPayments, or directly from accountingEntryDimensionTags.

- Querying accountingEntries allows you to retrieve entire entries with all their associated line items.

This is useful when you need the complete context of an entry, including all details of the related lines. - Querying accountingEntryLines directly is beneficial when you want to filter or aggregate specific line item data across multiple entries.

- Querying accountingEntryPayments directly gives you access to payment reconciliation information.

In this case, theaccountingEntryLinedataloader can be used to retrieve details of the corresponding entry line. - Querying accountingEntryDimensionTags gives you access to analytic allocations applied to each entry line.

You can use the

accountingEntryLinedataloader to retrieve the related line for each analytic tag.

accountingEntries

| Fields | Type | Description | Length |

|---|---|---|---|

| id | UUID | Id | |

| creationDate |

DateTime | Creation Date | |

| modificationDate |

DateTime | Modification Date | |

| sourceType |

|

indicates the origin of the accounting entry |

|

| date |

DateTime | Date | |

| documentDate |

DateTime | Document Date | |

| accountingExercise |

AccountingExercise | Fields of AccountingExercise | |

| accountingExerciseId | UUID | Id of AccountingExercise | |

| accountingPeriod |

AccountingPeriod | Fields of AccountingPeriod | |

| accountingPeriodId | UUID | Id of AccountingPeriod | |

| journalType |

JournalType | Fields of JournalType | |

| journalTypeId | UUID | JournalType Id | |

| session |

Session | Fields of Session |

|

| sessionId |

UUID | Session id |

|

| currency |

Currency | Fields of Currency | |

| currencyId |

UUID | Currency ID | |

| entryType |

|

Type of entry | |

| number | Int | Number |

|

| documentNumber | String | Document number or reference of the entry |

50 |

| tanNumber | Int | Counter that automatically increases by 1 (DE Only) | |

| description | String | Description |

200 |

| closeDate |

DateTime | closing date of entry | |

| isClosed | Boolean | True if closed | |

| accountingEntryLines[] | Array | List of all lines of entry |

|

| salesInvoice |

SalesInvoiceHeader | Sales Invoice Header Fields |

|

| sourceEntityId | UUID | If provided, see sourceType to identify the entity |

Info

- sourceType : Indicates the origin of the accounting entry, detailing how it was generated.

Each source type corresponds to a specific method or area within the business operations that has contributed to the accounting record. - number : operational Number Counter Id

- documentNumber : The reference number of the document. Mandatory in legislation DE. For purchases or sales, it can be filled with the invoice number.

- description : optional value, used as template for lines from the interface to assign default value to lines.

- accountingEntryLines : List of lines in the accounting entry, the accounting entry must be balanced, the total of the lines with a debit must be equal to the total of the lines with a credit. Adding an unbalanced entry will return an error.

- sourceEntityId : ID of a sales invoice, purchase invoice, collected payment, or issued payment, this value can be null.

If this value is provided, refer to the sourceType to determine the associated entity.

Note that salesInvoiceId holds the same value as sourceEntityId when sourceType=SALES - salesInvoice: Only invoice header fields are available. To obtain other information (such as lines, addresses, etc.), use the salesInvoice operation directly.

This dataloader salesInvoice is only relevant when the accounting entry was generated from a posted invoice created in the Sales module.

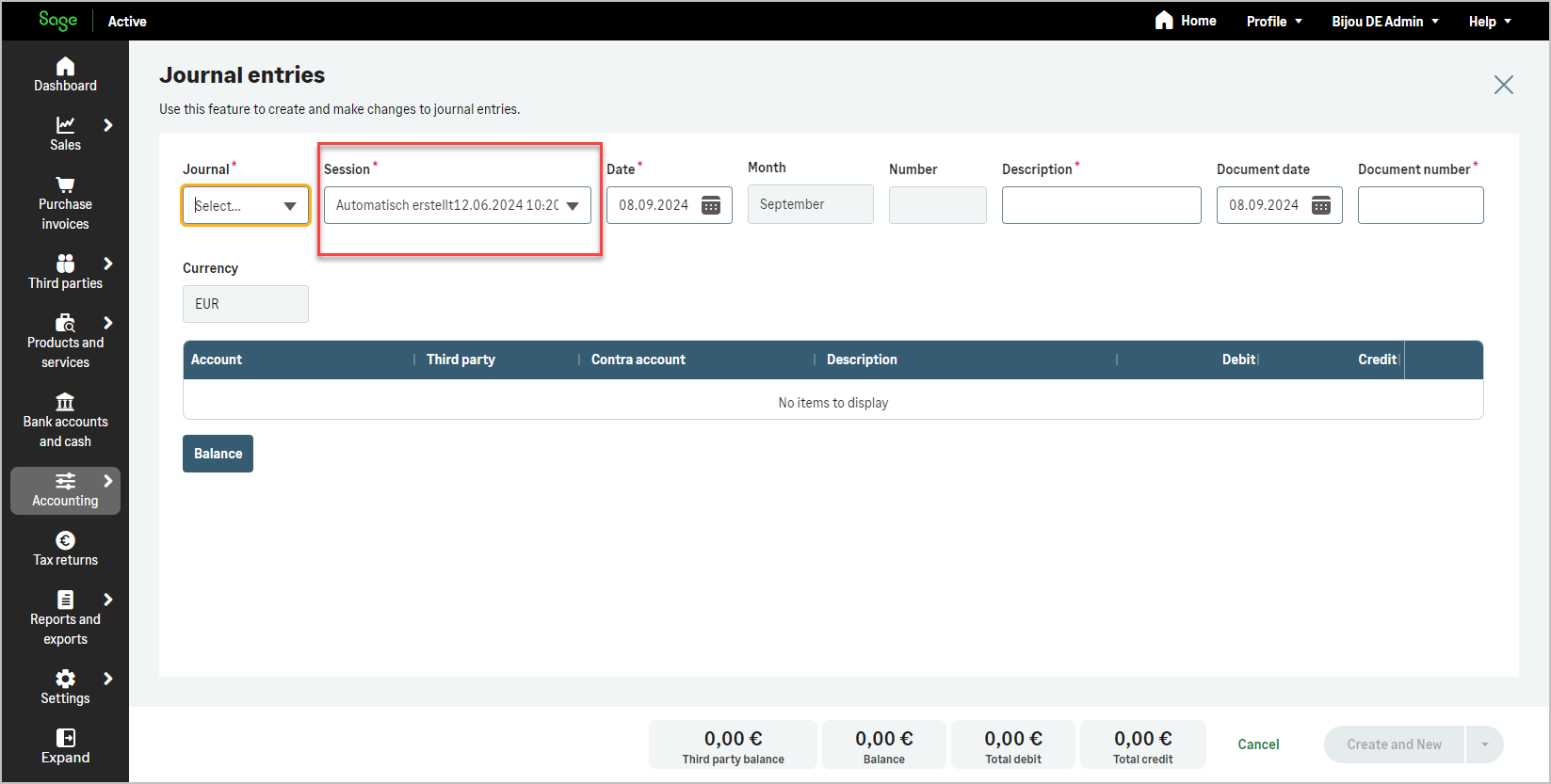

If the accounting entry was recorded directly in Accounting, this dataloader will not contain any information. - sessionId and session:

A session adds identifiable information to journal entries.Unused (For Germany only).

Unused (For Germany only).

- sessionId: the session identifier, this value is mandatory.

- session allows retrieving:

- id: the session identifier, which can be retrieved here or via sessionId.

- name: the session name (e.g.,

Automatisch erstellt) - stamp: the session name and timestamp (e.g.,

Automatisch erstellt 12.06.2024 10:20:04) - deactivated: the session status. When true, the session cannot be used for a new accounting entry.

accountingEntries/accountingEntryLines or directly from accountingEntryLines

If the query targets accountingEntries, then use accountingEntries/accountingEntrylines to get the details of the lines.

If the query targets accountingEntryLines, access the following fields directly, including the option to retrieve information on the parent accountingEntries.

| Fields | Type | Description | Length |

|---|---|---|---|

| id |

UUID | Id | |

| creationDate |

DateTime | Creation Date | |

| modificationDate |

DateTime | Modification Date | |

| accountingEntries Parent Information | |||

| accountingEntry |

AccountingEntry | Fields of the parent accountingEntries | 36 |

| accountingEntryId | UUID | accountingEntry ID | |

| subAccount |

AccountingAccount | Fields of AccountingAccount | |

| subAccountId | UUID | Id of accountingAccount | |

| order | Int | Classification of lines from 0 to n | |

| documentNumber | String | Document number or reference of the entry | 50 |

| contraAccount | String | Contra Account |

113 |

| description | String | Description | 200 |

| debitAmount | Decimal | Amount debit | |

| creditAmount | Decimal | Amount credit | |

| accountingEntryThirdParty | ObjectType | ThirdParty |

|

| accountingEntryPayment | ObjectType | Matching | |

| accountingEntryDimensionTags[] | Array | Analytics allocation of dimensions and tags | |

| accountingEntryInvoice | ObjectType | Invoice |

Info

- accountingEntryThirdParty :Lines with a third party

CUSTOMER,SUPPLIER,EMPLOYEE. - accountingEntryInvoice : Lines with a third party

CUSTOMER,SUPPLIERfor journal typesPURCHASE_INVOICEorSALES_INVOICE. - contraAccount : Lines with a general offset account.

Unused (For Germany only).

Unused (For Germany only).

Used only for Germany.

accountingEntries/accountingEntryLines/accountingEntryThirdParty

| Fields | Type | Description | Length |

|---|---|---|---|

| id |

UUID | Id | |

| creationDate |

DateTime | Creation Date | |

| modificationDate |

DateTime | Modification Date | |

| thirdPartyId | UUID | Third Id |

|

| socialName | String | Third Name |

70 |

| code | String | Code |

17 |

| origin |

|

Type of third | |

| identificationTypeId | UUID | DocumentType Id |

|

| documentId | String | Document Id |

25 |

| vatNumber | String | vat Number |

25 |

| countryAcronym | String | Country Acronym | 2 |

| viesCode |

String | VIES value prefix of the European Community VAT numbers |

Info

- thirdPartyId : Third party id :

- socialName : Found in the third party as

socialNamefor customer & supplier andnamefor employee. - code : Found in the third party as

code. - identificationTypeId : Found in the third party as

documentTypeId. - documentId : Found in the third party as

documentId. - vatNumber : Found in the third party as

vatNumber.

accountingEntries/accountingEntryLines/accountingEntryPayment

or directly from accountingEntryPayments

-

This section provides information about accounting reconciliation (also known as “matching”) of an entry line.

Reconciliation links different accounting entries that offset each other, such as an invoice and its payment. -

These details are available in read-only mode.

You cannot create or modify them directly via the API. -

You can also query

accountingEntryPaymentsdirectly.

In this case, the accountingEntryLine dataloader allows you to retrieve the details of the related entry line.

| Fields | Type | Description |

|---|---|---|

| id |

UUID | Id |

| creationDate |

DateTime | Creation Date |

| modificationDate |

DateTime | Modification Date |

| accountingEntry Line Parent Information |

||

| accountingEntryLine |

AccountingEntryLine | Fields of AccountingEntryLine |

| accountingEntryLineId | UUID | Id of the accounting entry line |

| matching |

|

Status matching |

| matchingLetter | String | Letter matching |

| matchId | UUID | Id of the match |

Info

- matching: Indicates how the entry line has been matched.

PARTIAL_MATCHmeans the entry is partially reconciled, whileFULL_MATCHindicates a complete reconciliation. - matchingLetter: Used to group matched entries under a common letter.

Lowercase letters are used for partial matches (a,b,c…), uppercase letters for full matches (A,B,C…) - matchId: Technical grouping key.

All lines that are matched together share the samematchId, regardless of the matching letter used. This avoids ambiguity when letters are reused.

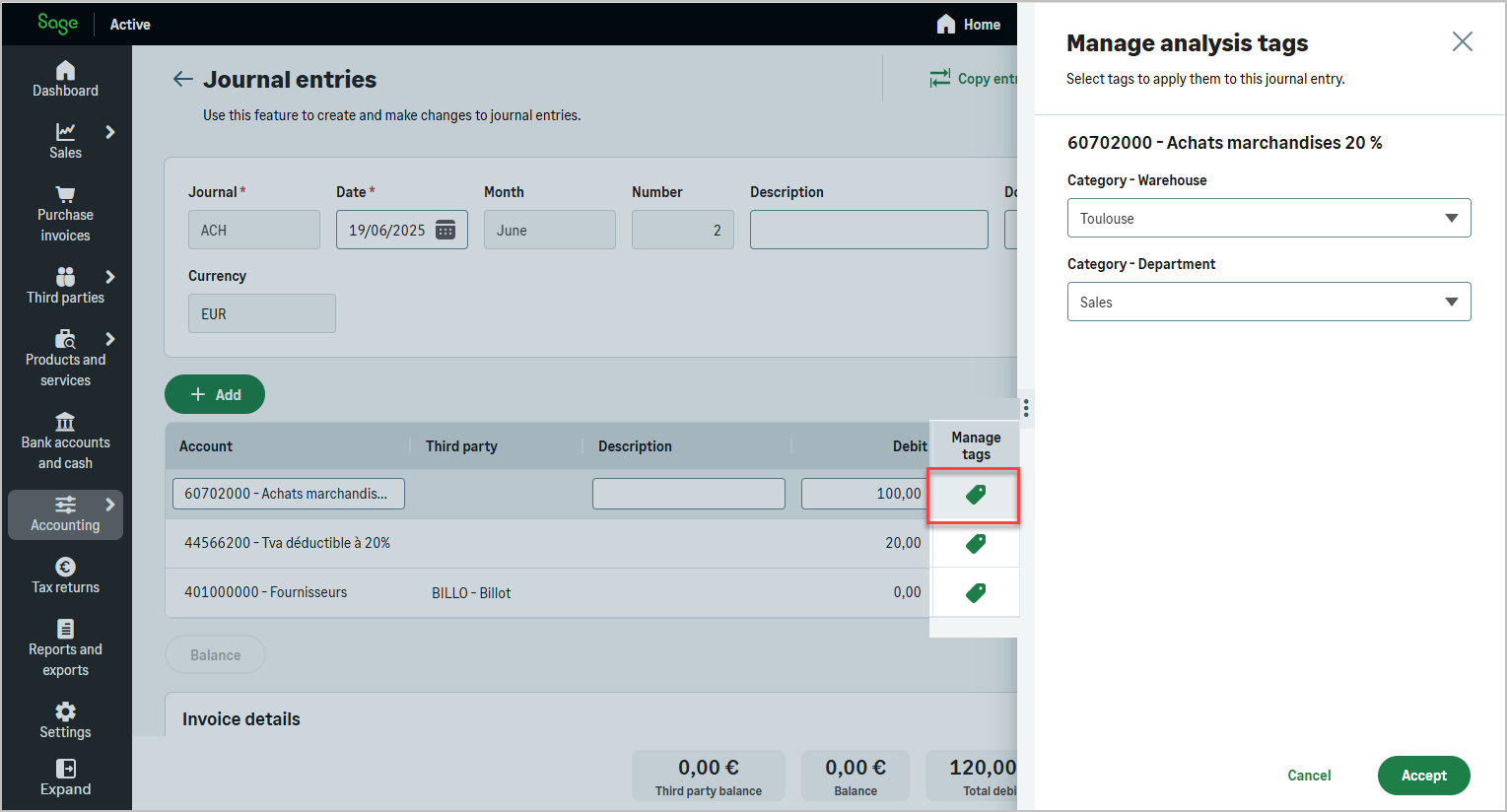

accountingEntries/accountingEntryLines/accountingEntryDimensionTags or directly from accountingEntryDimensionTags

-

Typical examples include dimensions such as

Warehouse,Department, orProject. -

Each dimension is configured with a list of tags, which define the allowed values for that dimension.

For example, theWarehousedimension may include tags such asLyon,Toulouse, andRouen, each representing a specific location used in allocation. -

When creating accounting entries, you can allocate each line across one or more analytic dimensions by assigning a specific tag from the list defined for each dimension.

-

You can also configure accounts in the chart of accounts to assign default dimension tags, which will be automatically applied to entry lines using those accounts.

See API resources overview / Accounting Accounts / AccountingAccountDimensionTag

- You can also query

accountingEntryDimensionTagsdirectly.

In this case, the accountingEntryLine dataloader allows you to retrieve the details of the related entry line.

Example: Analytic Allocation on Accounting Entry Lines

The list of available dimensions and their tags is defined in your setup:

- Configured Dimensions

- Dimension 1:

Warehouse- Available Tags:

Toulouse,Lyon,Rouen

- Available Tags:

- Dimension 2:

Department- Available Tags:

Sales,Logistics,R&D

- Available Tags:

- Dimension 1:

Suppose you allocate an entry line to:

- Warehouse →

Toulouse -

Department →

Sales - The full amount of the accounting entry line is allocated to both tags.

| Fields | Type | Description |

|---|---|---|

| id |

UUID | Id |

| creationDate |

DateTime | Creation Date |

| modificationDate |

DateTime | Modification Date |

| accountingEntry Line Parent Information | ||

| accountingEntryLine |

AccountingEntryLine | Fields of AccountingEntryLine |

| accountingEntryLineId | UUID | Id of the accounting entry line |

| Dimension and Tag Information | ||

| dimensionId | UUID | Id of the dimension (e.g. Warehouse) |

| dimensionTagId | UUID | Id of the selected tag |

| amount | Decimal | Allocated amount on this dimension |

Warning

-

Analytic dimension and tag information is currently read-only.

You cannot assign or modify these values through the API at this stage. -

Dataloaders are not currently available for analytic dimensions and dimensionTags.

This means that if you need to retrieve additional details (e.g., dimension name for a givendimensionId), you must manually correlate the values using the identifiers (idfields) returned by the API.

Info

- dimensionId: Refers to the analytic category (e.g. Warehouse, Department, Project).

- dimensionTagId: Refers to a tag that belongs to the selected dimension.

- amount: Specifies how much of the accounting entry amount is allocated to this tag.

accountingEntries/accountingEntryLines/accountingEntryInvoice

| Fields | Type | Description | Length |

|---|---|---|---|

| id |

UUID | Id | |

| creationDate |

DateTime | Creation Date | |

| modificationDate |

DateTime | Modification Date | |

| documentDate | DateTime | Date of the invoice | |

| operationDate | DateTime | Fulfilment date of the invoice | |

| externalInvoiceNumber | String | Invoice number | 50 |

| isCashVat | Boolean | True if Cash VAT (FR and DE only) | |

| amount | Decimal | Amount of the invoice | |

| openItems[] | Array | open Items | |

| accountingEntryTaxes[] | Array | Tax registers |

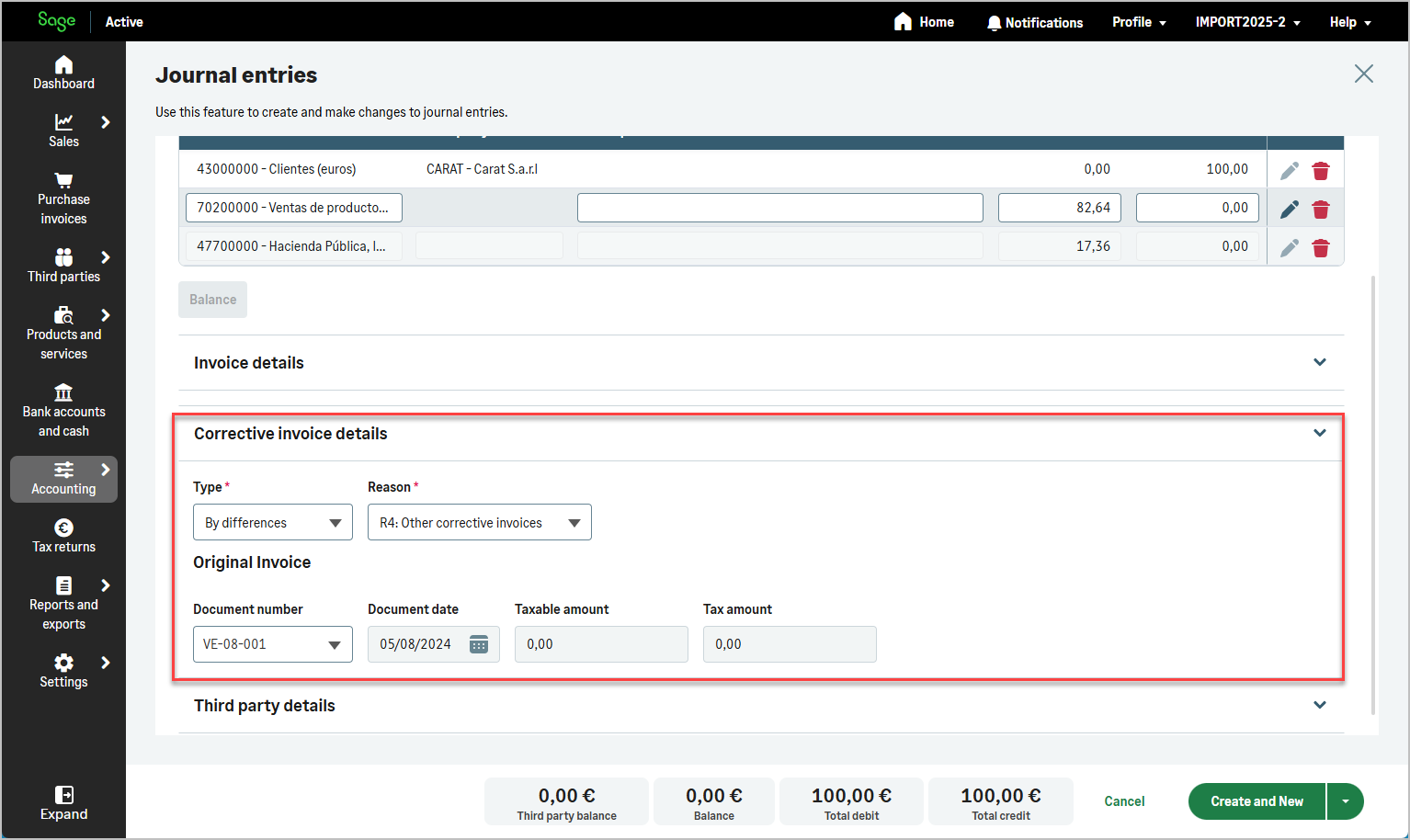

Corrective invoices (Only for Spanish legislation)

Corrective invoices align with the Spanish VAT regulation (Reglamento de Facturación - Real Decreto 1619/2012), which distinguishes between two types of corrective invoices (facturas rectificativas) based on whether they adjust the original invoice or fully replace it.

| Fields | Type | Description |

|---|---|---|

| creditNoteType |

|

Specifies the category of the corrective invoice according to Spanish VAT regulations. |

| creditNoteReason |

|

Specifies the reason for issuing the corrective invoice. |

| originalEntryInvoiceTaxesBaseSum | Decimal | Total taxable base amount of the original invoice being corrected. |

| originalEntryInvoiceTaxesSurchargeAmountSum | Decimal | Total surcharge amount applied to the original invoice. |

| originalEntryInvoiceTaxesTaxAmountSum | Decimal | Total tax amount of the original invoice being corrected. |

| originalAccountingEntryInvoice |

AccountingEntryInvoice | Provides access to the accountingEntryInvoice of the original invoice, notably to retrieve its externalInvoiceNumber and documentDate. |

| originalAccountingEntryInvoiceId | UUID | ID of the original invoice |

Info

creditNoteType- ByDifferences → “Rectificativa por diferencias”

- Used when the corrective invoice partially adjusts the original invoice (e.g., correcting price differences or quantity errors).

- The original invoice remains valid, but its amounts are adjusted.

- Common cases include VAT miscalculations, incorrect unit prices, or missing line items.

- Substitutive → “Rectificativa sustitutiva”

- Used when the original invoice is entirely replaced by the corrective invoice.

- The original invoice is considered null and void, and the new invoice takes its place.

- Often used when an invoice was issued incorrectly (e.g., wrong client details, incorrect tax rates, or errors affecting the entire invoice).

- Undefined → No specific classification; used as a fallback when the corrective invoice type is unknown or not applicable.

- ByDifferences → “Rectificativa por diferencias”

creditNoteReasonR1: Return of packaging- Used when goods include packaging that is later returned, requiring an invoice adjustment.

R2: Bankruptcy proceedings- Issued in cases where the debtor enters bankruptcy and VAT correction is needed.

R3: Bad debt- Used when the original invoice cannot be collected due to non-payment, allowing VAT recovery.

R4: Other corrective invoices- Covers general corrections not included in other predefined categories.

R5: Simplified invoice correction- Used when correcting simplified invoices (i.e., receipts instead of full invoices).

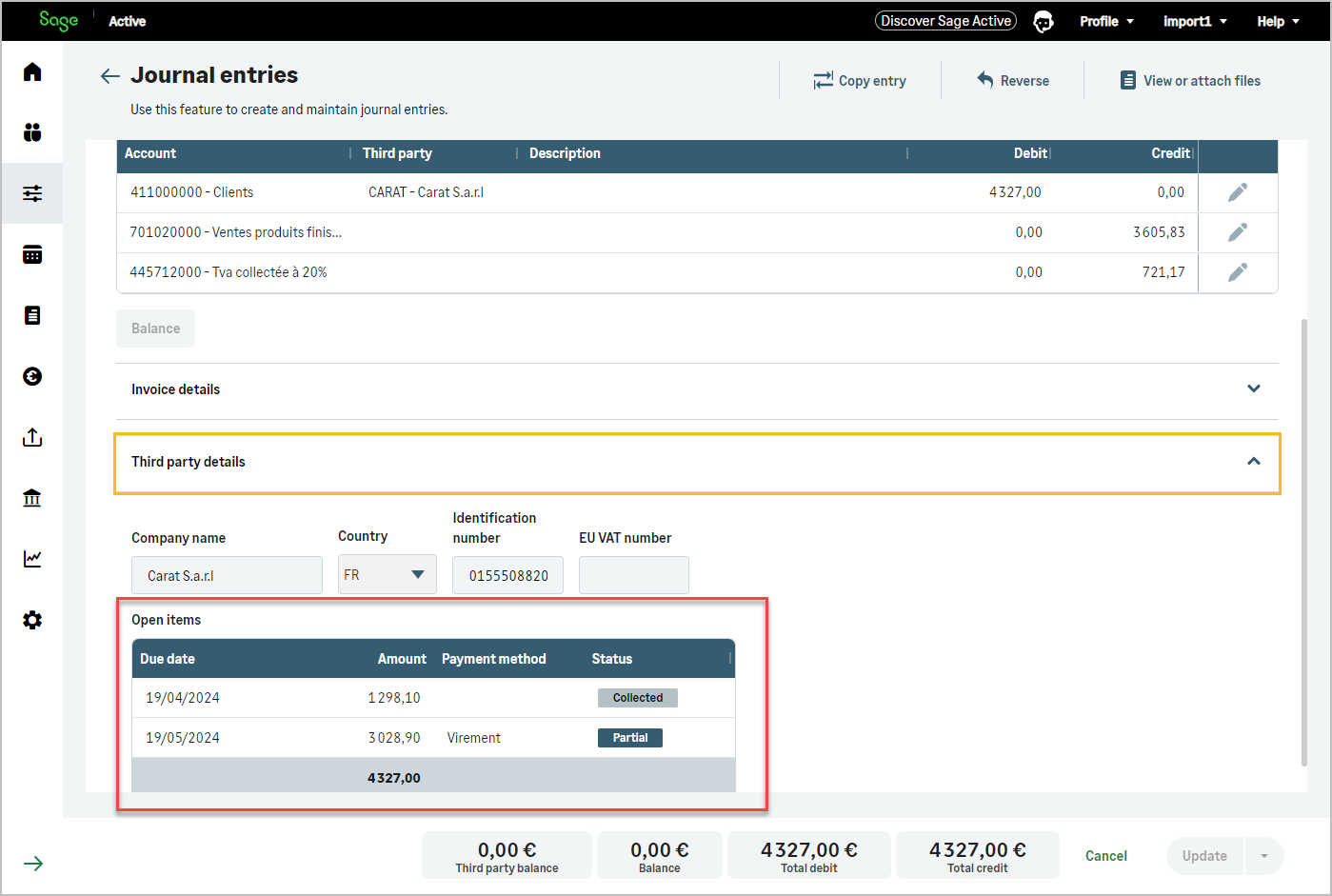

accountingEntries/accountingEntryLines/accountingEntryInvoice/openItems

Each open item includes detailed information such as the total amount, accumulated amount paid, and the payment due date.

For a single invoice, there can be as many open items as there are different payment installments, which is why openItems is structured as an array to accommodate multiple entries per invoice.

The payment status provides insight into the progress of settling each item.

Additionally, the identifier of the payment method used is provided to track the settlement method.

| Fields | Type | Description |

|---|---|---|

| id |

UUID | Id |

| creationDate |

DateTime | Creation Date |

| modificationDate |

DateTime | Modification Date |

| amount | Decimal | Total amount of the item |

| paidAmountAccumulated | Decimal | Accumulated amount that has been paid |

| dueDate |

DateTime | Due date for the payment |

| status |

|

Status of the payment |

| paymentMean |

PaymentMean | Fields of PaymentMean |

| paymentMeanId | UUID | Identifier of the payment method used |

Info

- amount : Total amount due for the open item.

- creationDate : Indicates when the item was initially created.

- modificationDate : Timestamp of the last update to the item, null if no updates have been made.

- paidAmountAccumulated : Total amount that has been paid towards the item up to the current date.

- dueDate : Date by which the payment for the item is due.

- status: Represents the current status of the payment, indicating the extent to which the item has been settled. The possible values are:

NOT_SPECIFIED: No specific payment status has been detailed.COLLECTED: Payment has been fully collected from customers.PAID: Payment has been fully made to suppliers.PARTIAL: Payment for the item has been made partially.

accountingEntries/accountingEntryLines/accountingEntryInvoice/accountingEntryTaxes

| Fields | Type | Description |

|---|---|---|

| id |

UUID | Id |

| creationDate |

DateTime | Creation Date |

| modificationDate |

DateTime | Modification Date |

| taxTreatmentId | UUID | Id of the tax Treatment |

| taxGroupId | UUID | Id of the Taxe Group of tax treatment |

| taxType |

|

Tax Type of the tax treatment |

| taxId | UUID | Id of the tax |

| taxPercentage | Decimal | Percentage of the tax found by groupId=taxGroupId |

| taxBase | Decimal | Base of tax calculation |

| taxAmount | Decimal | Tax amount |

| deductible | Boolean | true for a deductible tax, false for a collected tax |

| regimeType |

|

Always fill in GENERAL |

| hasEquivalenceSurcharge | Boolean | Indicates whether the equivalence surcharge is applied. |

| equivalenceSurchargePercentage | Decimal | Percentage applied for equivalence surcharge. |

| equivalenceSurchargeQuota | Decimal | Fixed amount of the equivalence surcharge quota (if applicable). |

Info

- taxTreatmentId : A tax Treatment is associated to each line of acounting Entry taxes. see Taxes Treatments

- taxGroupId : found in Taxes Treatments

- taxType : found in Taxes Treatments

-

taxPercentage : Percentage of the tax found in tax

- Equivalence Surcharge Fields

Unused (For Spain only).

These fields relate to the equivalence surcharge (Recargo de Equivalencia), a special VAT regime applicable to specific Spanish retailers.

- hasEquivalenceSurcharge: Indicates whether the surcharge applies to the invoice.

- equivalenceSurchargePercentage: The percentage applied when the surcharge is enabled, depending on product type.

- equivalenceSurchargeQuota: An optional fixed amount used instead of a percentage, in specific tax contexts.

Unused (For Spain only).