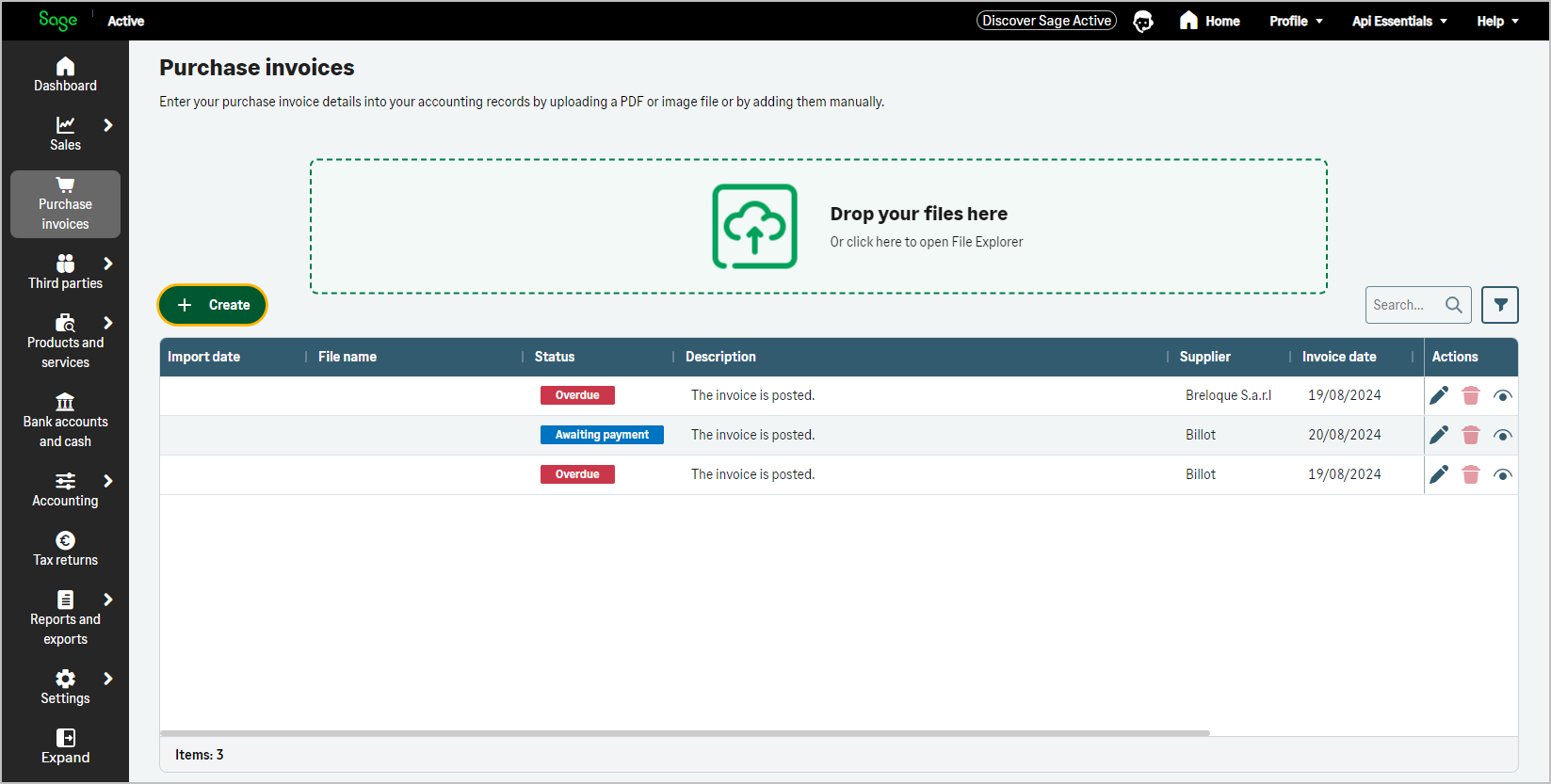

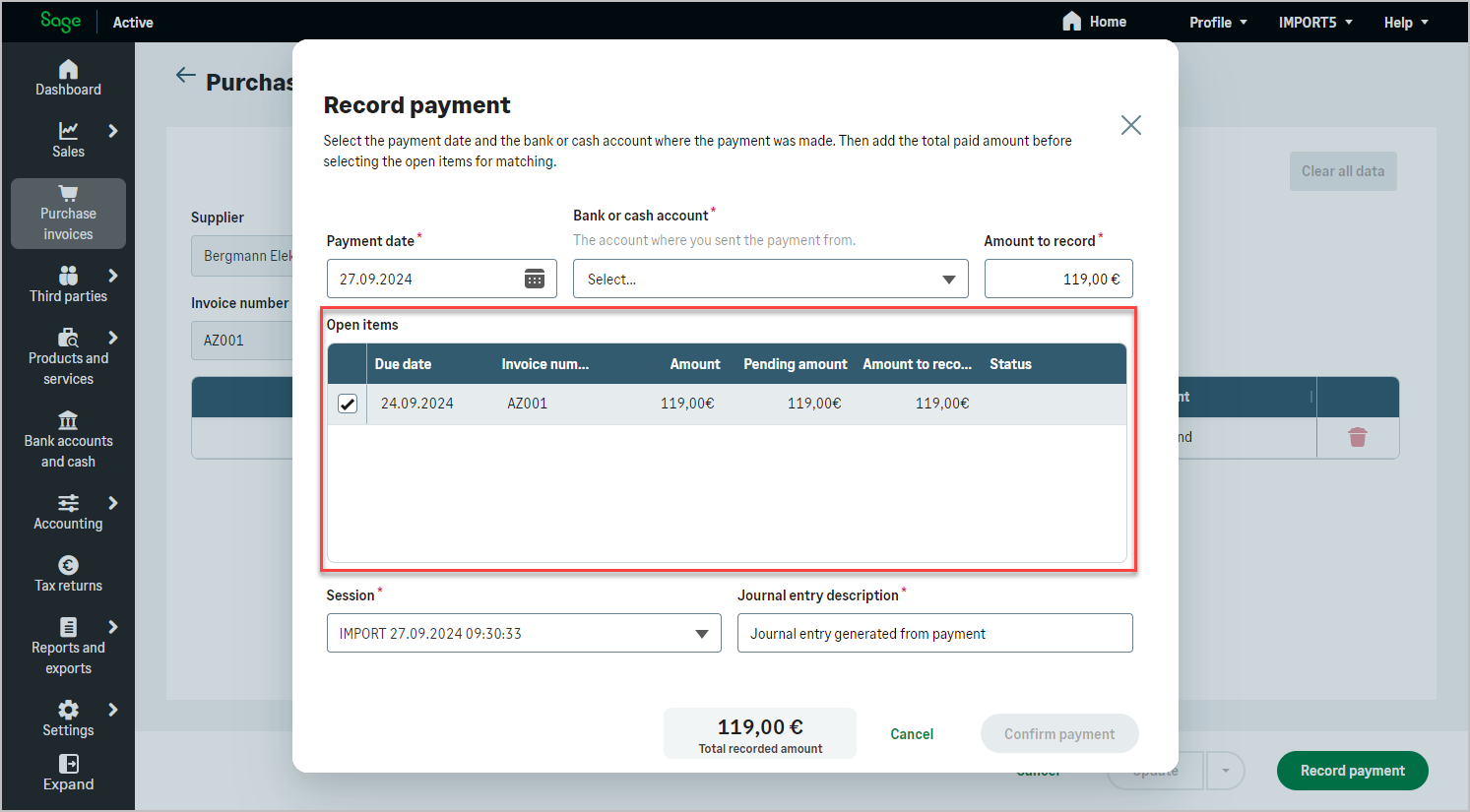

This resource is pivotal for managing payments to suppliers after receiving goods or services and serves as a legally binding documentation of the purchase.

The Purchase Invoices entity utilizes a simplified model that primarily includes key information of the purchase invoice: invoice number, invoice date, fulfillment date, total amount, amount excluding tax, and taxes.

This ensures compliance and contributes to a smoother accounts payable process.